Reframing the stranded assets narrative for European private financial institutions

The implementation of the new banking package (or Capital Requirements Directive package) that adopts the final parts of the international Basel 3 financial regulation is underway in the European Union. The European Banking Authority (EBA) along with the other European Supervisory Authorities (ESAs) is mandated to develop technical standards that provide the framework to help financial institutions comply with the new regulatory rules. Key among these standards is the novel guidance on ESG risks which is expected to be finalised by the EBA in the coming months. This is an opportune moment to address weaknesses in banks’ risk management practices, particularly regarding the underestimation of stranded asset risks, a missing angle in current policy debates.

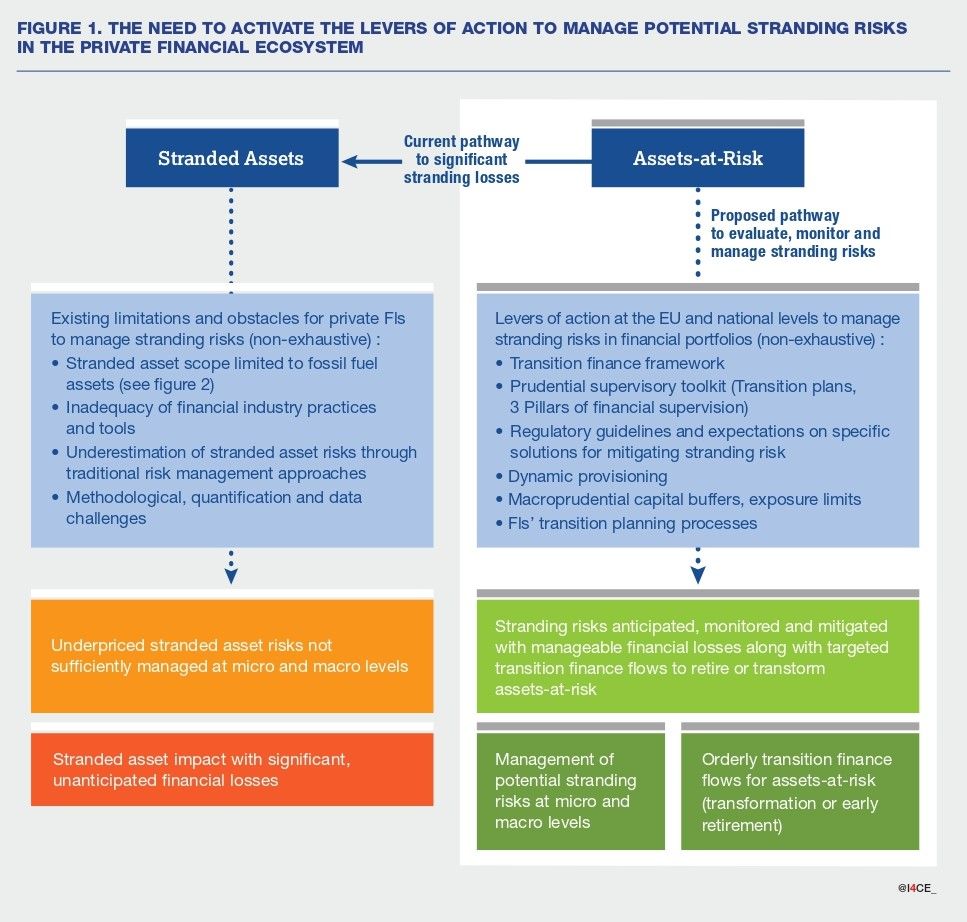

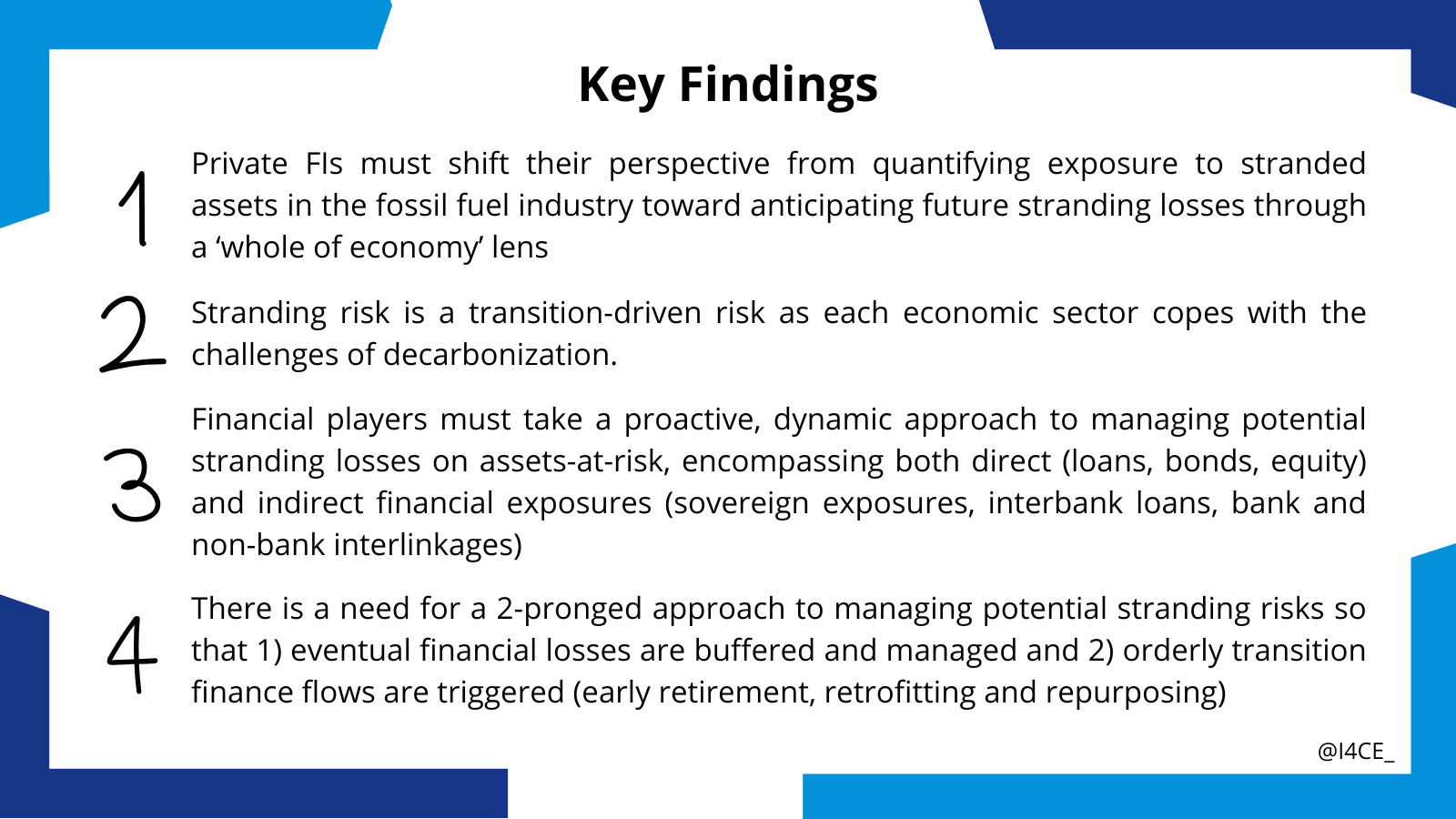

Private financial institutions (FIs), particularly banks, hold a narrow, limited view on stranded asset risk, focussing mostly on quantifying losses from fossil fuel assets. But as the low-carbon transition plays out in varying degrees across sectors, any economic asset could face unanticipated depreciation to some extent. FIs should not see asset stranding as an isolated risk, but rather as another transition-driven risk that warrants being evaluated under the transition risk framework. It is crucial to reframe the narrative from the static stranded assets to the dynamic ‘assets-at-risk’ perspective that allows proactively identifying potential stranding risks on a ‘whole of economy’ lens.

I4CE’s discussion paper coins ‘assets-at-risk’ across sectors such as the real estate, automobile, agriculture and the energy sectors. For the automobile sector, stranding losses arise not only from the ‘creative destruction’ to transform massive fleets from internal combustion engines (ICE) to electric vehicles (EV), but also from green assets (such as battery manufacturers) that are facing lukewarm demand for EVs in European markets. Importantly, the ‘greenness’ of an asset does not directly translate into a measure of transition risk as the latter is determined by a plethora of financial and non-financial parameters that constitute the ‘transition readiness’ of a counterparty.

What prevents financial institutions from adopting a proactive approach to managing potential stranding risks? Like transition risks, stranding risk assessments are burdened with the same quantification, methodological and data challenges. The high uncertainty over future economic and policy that influence the economic lifespan of assets (or, eventual degree of stranding) makes quantification difficult. The traditional risk-based approach underestimates future stranding risks which usually lie beyond the short-term risk-reward function. Financial players struggle to recognize the dynamic transformation pathway for carbon-intensive assets as industry standards and classifications often stick to binary approaches, i.e. green vs non-green. These multiple challenges result in significant underpricing of stranding risks in both primary and sector finance sectors.

How can financial policy counter these weaknesses of the financial sector? A coordinated effort between European and national regulation and prudential supervisors is needed to better mitigate potential stranding risks in an orderly manner that limits financial stress on markets. Moreover, the macro and mircoprudential policy toolkit could help buffer eventual stranding losses and trigger necessary transition finance flows to help retire, retrofit or transform assets-at-risk before they become fully stranded. Prudential transition plans are a useful tool in this regard. This is also recognised in the recently published Strategic Dialogue on the future of EU Agriculture. It calls for prudential expectations on credible indicators and sectoral pathways aligned with national and European sustainability targets to help banks better finance the transition activities of farmers. From the supervisory lens, the EBA guidelines must reinforce the pillar 2 supervisory framework so that banks integrate stranding risk assessments within their overall transition planning and risk management processes.