What does « Alignment with the Paris agreement» mean ?

I4CE has just released a “framework for Alignment with the Paris Agreement”, Alice Pauthier discusses here what “Alignment” simply means.

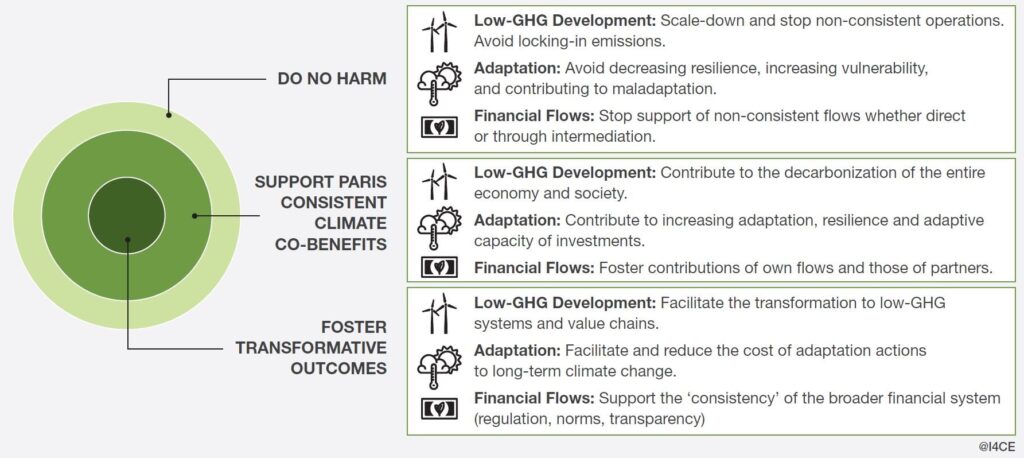

Paris Alignment: stopping harm and supporting transformation

Since the signature of the Paris Agreement, more and more financial institutions and economic actors are committing to ‘align with its goals’. However, there is currently no common understanding of what ‘Alignment’ with the Paris Agreement means. In our recent report, I4CE has gone back to the Paris Agreement to propose a framework to help define this concept and process. Our results stress that a commitment to “Paris Alignment” is a commitment to support the achievement of the three goals of the Paris Agreement on mitigation, adaptation and finance. To do so, actors and institutions need to scale-down all activities that do not contribute to these goals – and seek whenever possible to contribute to both the incremental and transformative changes needed to achieve a low-GHG, climate-resilient development. While action on climate change must occur globally, actors should seek to take into account the national contexts and pathways of economies and societies.

How is this different from what financial institutions and other actors are already doing on climate change?

Governments, financial institutions and economic actors have often started to integrate climate change in their strategies and operations. Paris Alignment implies building on these existing approaches – but requires to take into account three additional ‘dimensions’:

- First, actors should look across all of their activities and consider their impact on systems and value chains.

- Second, actors should look at both the near-term effects of its activities on climate action (emissions, resilience), but also seek to make sure it is also supporting a decarbonized and resilient future.

- Third, actors should actively seek to contribute to climate goals by ensuring that all activities 1) Do No Harm; 2) Support Paris-Consistent Climate Co-Benefits; and 3) whenever possible Foster Transformative Outcomes.

Which actors will take action to align with Paris and why?

All economic actors – whether seeking sustainable development impacts or with a commercial focus – have an interest to align their activities with the long-term goals of the Paris Agreement:

- Many will be called to directly contribute to the achievement of the long-term climate goals by shareholders and other stakeholders;

- All will need to manage the risks and opportunities associated with the needed transformation of the economy and the financial environment; and

- All will need to take into account and respond to the changing physical climate.

However, the direct contribution of each economic actor to achieving these long-term goals will vary depending on their mandates, roles and responsibilities. Not all will be able to value and take into consideration non-financial returns on investment. In all cases, they will nevertheless need to rapidly scale-down their counterproductive activities and “Do No Harm”.