Thinking about the implications: How countries plan to finance their climate transition

The urgency of climate action is becoming ever more apparent, yet we remain far from securing the level of financing required for meaningful progress. The first Global Stocktake underscored a widening gap between the needs of developing countries and the support they receive, while advanced economies also struggle to finance their own ambitious climate targets.

Countries need detailed, nationally-driven financing plans to enable an efficient, locally-owned transition and to better coordinate—and scale up—scarce international resources. These plans are crucial for aligning public and private efforts, financing national priorities, preventing stranded assets, and embedding climate considerations within broader development strategies. They are guided by four key questions: How much to spend, where, and when? Who will invest, and who will finance these investments? What is needed for these payments to happen? And finally, what are the macroeconomic impacts of the transition?

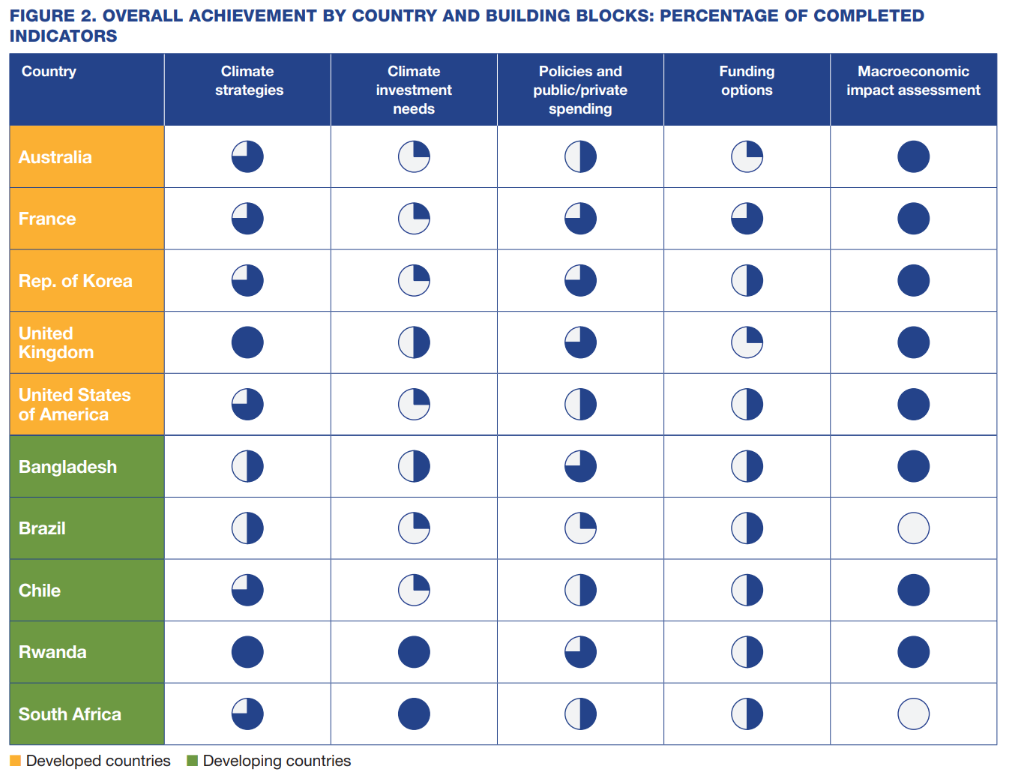

This study reviews existing practices in 10 geographically and economically diverse countries to support the development of such financing plans, identifying good practices and areas for inspiration and improvement. It uses 45 progress indicators, structured around the questions above, to understand where countries are today in the process of developing such financing plans.

This first assessment shows that many milestones have already been reached on the way to ambitious financing plans: on average, 60% of our indicators are filled in the surveyed countries. However, significant gaps remain, with key elements still absent or underdeveloped.

Country level estimates of financing needs remain generally inadequate. Even in countries where such estimates are provided, the sectoral/temporal detail is often too limited to serve as a basis for a real financing plan. Moreover, the closer the time horizon, the less information is provided on indicators related to transition planning, indicating a disconnect between more mature long-term visions and short-term actions that are comparatively more like flying blind.

The question of how the effort will be shared is still poorly addressed. Details of who will pay and through what channel are rarely provided, making it difficult to reflect on the public policies that should trigger these investments. Most countries lack clear frameworks or incentives to mobilize sufficient private finance, and financing options for public action are also underexplored, especially on the domestic resource mobilization side.

Finance will take center stage in the next two years of international negotiations. The partial success of COP29 negotiations shifts maximum pressure to the year leading up to COP30, which is set to formalize increased international ambition and adopt the next generation of NDCs in November 2025. In this context, our preliminary findings highlight the need to:

- Advancing country-owned, bottom-up, and detailed identification of investment and financing needs, tailored to national circumstances and targets, and broken down over time.

- Pairing this with a systematic review of available financing options, including domestic, international, public, and private sources.

- Applying these insights not only to long-term strategies but also incorporating them into short-term planning frameworks that guide national authorities’ actions.