From Stranded Assets to Assets-at-Risk: Reframing the narrative for European private financial institutions

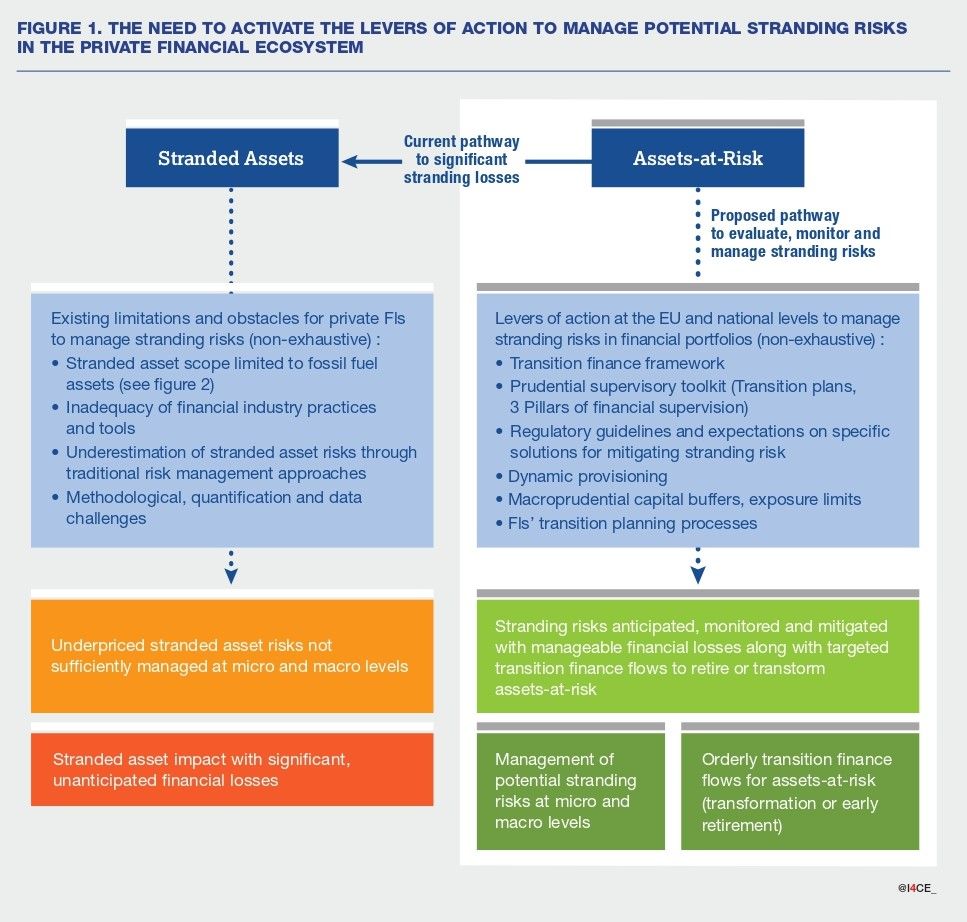

Private financial institutions must rethink their approach to managing stranded asset risks. The current narrative on quantifying fossil fuel sector exposures within a limited scope of financial portfolios (mostly loans) largely underestimates potential stranding losses. As the low-carbon transition impacts all economic sectors, private financial institutions (FIs) must consider material transition-driven stranding risks within their overall transition risk management framework using a ‘whole of economy’ lens. Traditional risk management approaches are ill-suited to the methodological and quantification challenges of transition-driven stranding risks, so a flexible, dynamic, forward-looking approach is necessary.

Strong, incentivising public policy coordinated with financial regulatory and supervisory impetus is necessary to preemptively identify, monitor and manage stranding losses on ‘assets-at-risk’ (i.e., potential stranded assets). The ECB finds that 40% of the total loan portfolio of euro area banks is exposed to energy-intensive sectors*, making them vulnerable to transition risks, including stranding. It is time for an urgent reframing of the stranded asset narrative to avoid significant financial losses (endangering financial stability) and direct orderly transition finance flows to retire or transform assets-at-risk before they become fully stranded.

1. Shifting from the narrow and static ‘Stranded Assets’ to the wide and dynamic ‘Assets-at-Risk’

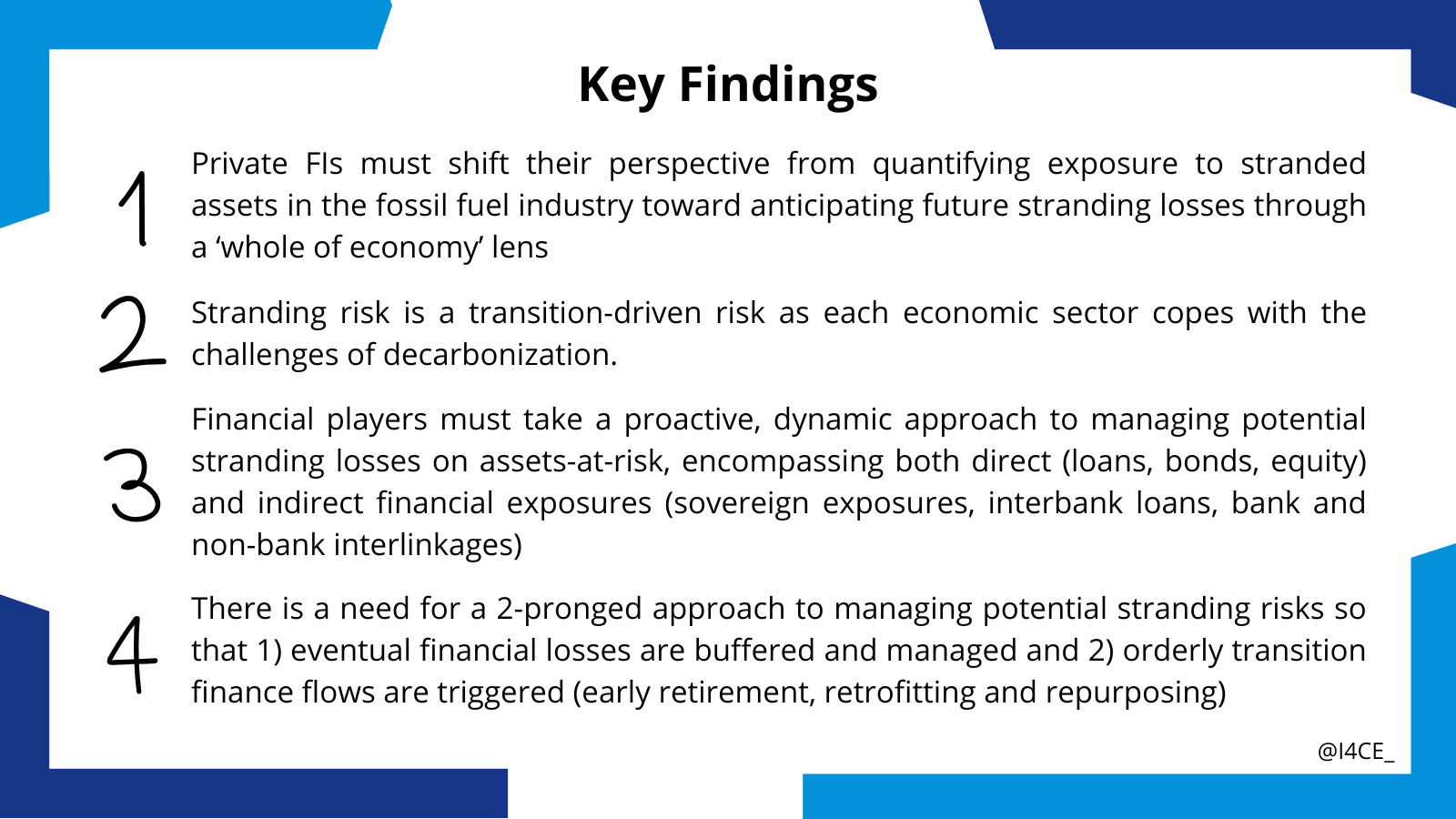

Private FIs must shift their perspective from quantifying exposure to stranded assets in the fossil fuel industry toward anticipating future stranding losses through a ‘whole of economy’ lens. Stranding risk like any other transition risk is contingent on the evolution of the transition pathway, which remains highly uncertain. Financial players must take a proactive, dynamic approach to managing potential stranding losses on assets-at-risk, encompassing both direct (loans, bonds, equity) and indirect financial exposures (sovereign exposures, interbank loans, NBFI‑bank interlinkages). Assessing stranding risks within a comprehensive transition risk framework is crucial, as it allows for better anticipation of future financial losses by assessing a counterparty’s ability to withstand stranding losses on assets‑at‑risk.

2. However private FIs face several obstacles in monitoring and managing stranding risks proactively

The existing tools, policies and practices adopted by private FIs are insufficient to capture potential stranding risks. Sector financing policies, net-zero commitments and alignment measures often do not include relevant financial exposures across the entire value chain. The traditional risk-based approach underestimates future stranding risks which usually lie beyond short-term risk-reward perceptions. Like transition risks, stranding risk assessments are burdened with the same quantification, methodological and data challenges. FIs face difficulty in relating asset ‘greenness’ with ‘transition readiness’ of counterparties, with limited capacity to finance the dynamic transformation pathway of assets (from non-green to green**). Primary and secondary finance sectors both underprice stranding risks, which amplify through financial interlinkages, threatening overall financial stability.

3. Public policy, financial regulation and supervision could help counter these obstacles

The management of the potential stranding effects on assets-at-risk necessitates strong public policy providing clear signals and incentives to financial players. The prudential regulatory and supervisory toolkit (including progress on transition finance) is vital to managing transition-driven stranding risks involving specific mitigation solutions to stranding such as early retirement, retrofitting and repurposing of assets.

Financial regulation could reinforce system resilience to stranding contagion effects, especially from financial interlinkages and monitor ‘risk offloading’ strategies that weaken transition finance mobilization. There is a need for a 2‑pronged approach to managing potential stranding risks so that 1) eventual financial losses are buffered and managed and 2) orderly transition finance flows are triggered.

It’s time to reframe the way private financial institutions think about stranded assets.

In this video, I4CE highlights the limitations of the current narrow approach used by private financial institutions (FIs) to capture stranded asset risk in their portfolios. We argue for a ‘whole of economy’ lens with a proactive approach to better identify and mitigate stranding losses on ‘assets-at-risk’. Financial regulators and supervisors must leverage their toolkit to encourage FIs to proactively manage stranding risks.

* Emambakhsh et al., ‘The Road to Paris: Stress Testing the Transition Towards a Net-Zero Economy’.

**This paper borrows the common definition of green assets (or activities) in the context of the EU Taxonomy Regulation. https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32020R0852