Social and Climate Budget Tagging: Insights from Indonesia

Attention is growing to the need to tackle climate and social issues jointly. Indeed, both climate change and climate policies affect social issues such as poverty, inequality, or access to healthcare. A well-known example is that of carbon pricing, a climate policy which can have regressive effects in some contexts. As another example, climate change induced heatwaves are disproportionately likely to impact poorer individuals who typically have more constrained access to healthcare, physical jobs in outdoor conditions, and through indirectly driving up food prices. To foster an effective and sustainable transition to low-carbon and resilient economies, policymakers need to ensure individuals do not lose more from climate policies than they already lose from the effects of climate change, but instead benefit from them.

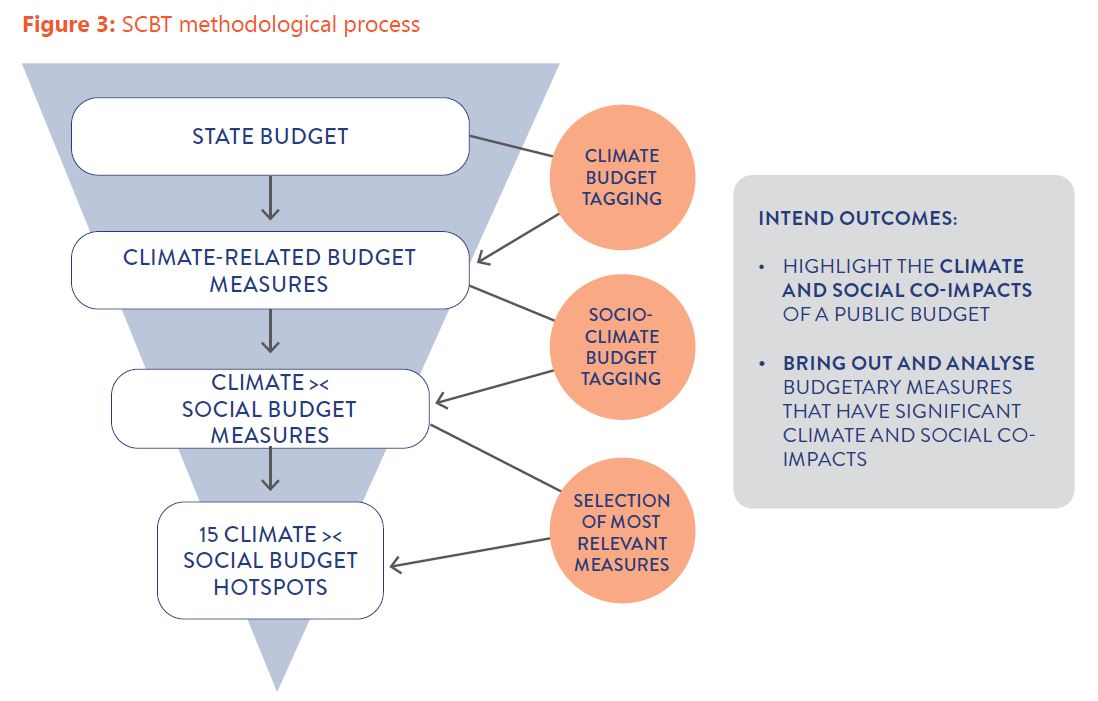

I4CE has developed a tool to help policymakers identify climate policies in their national budgets with likely social co-benefits: the Social Climate Budget Tagging (SCBT). Based on Climate Budget Tagging (CBT) methodologies which are increasingly used by Ministries of Finance worldwide, the SCBT highlights the likely social effects of climate-related budgetary measures. It allows users to identify climate policies to which more public resources should be dedicated – those with likely positive social effects -, and budget measures with positive or negative climate effects as well as with likely negative social effects. These measures should typically be removed, diminished, or individuals should be compensated for their effects.

Initially developed on the basis of France’s ‘Green Budget’, the SCBT was refined, adapted and applied to Indonesia’s 2021 Climate Budget Tagging. The application of the SCBT reveals that all climate measures in Indonesia have significant social effects, whether positive or negative. More specifically, it delivers insight on 12 climate policies to which particular attention should be paid, given their high social effects: climate and social ‘hotspots’. Fiscal incidence analysis — which is used to identify individuals, households, communities, and activities likely to experience positive or negative impacts of the execution of fiscal policies (taxes and transfers) — combined with the SCBT helps understand how measures in the CBT affect welfare, poverty, and inequality at the microeconomic level. Using these individual — or household-level impacts, incidence analysis can estimate the relationship between policies in the CBT, climate and social ‘hotspots’, and economywide social welfare indicators like the rate of poverty and vulnerability or income inequality.

Uptake of the SCBT in Indonesia is particularly relevant in the context of the recently announced Just Energy Transition Partnership (JETP) and other climate justice agreements. It also greatly extends the first version, developed in and for France; since the context and challenges faced by these two countries are radically different, embarking them both makes SCBT fit for a wide variety of countries and contexts. The SCBT methodology, user guidelines, and the tool are available as annexes to this report.