Carbon Price Flaw? The impact of the UK’s CO2 price support on the EU ETS

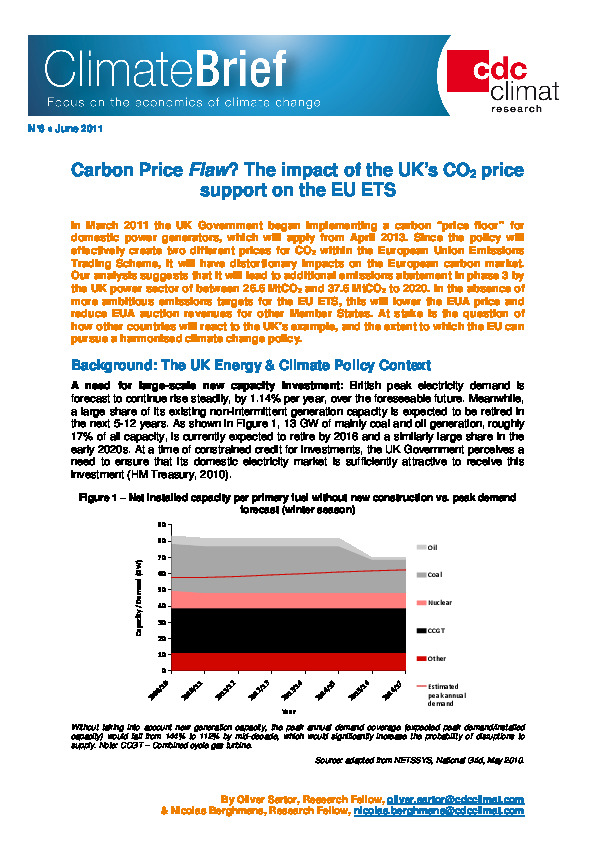

In March 2011 the UK Government began implementing a carbon “price floor” for domestic power generators, which will apply from April 2013. Since the policy will effectively create two different prices for CO2 within the European Union Emissions Trading Scheme, it will have distortionary impacts on the European carbon market. Our analysis suggests that it will lead to additional emissions abatement in phase 3 by the UK power sector of between 26.6 MtCO2 and 37.6 MtCO2 to 2020.