Carbon pricing Q&A

Frequently asked questions on the development and implementation of carbon pricing policies

This work aims to provide a carefully curated companion tool for jurisdictions considering or developing a carbon pricing instrument, with questions and answers (Q&A) focused on opportunities they can bring, specific challenges and policy choices pertaining to the design and implementation of carbon taxation and emission trading systems in emerging markets and developing economies (EMDES).

The questions addressed have been identified as the ones frequently asked by EMDEs, particularly in the context of exchanges with the European Commission and its Task Force on International Carbon Pricing and Markets Diplomacy (CLIMA.TF).

Answers to most questions included in this Q&A largely build on existing reports and resources by key institutions with expertise on carbon pricing, notably the World Bank Group (WBG) and the International Carbon Action Partnership (ICAP).

Expert input also fed answers to the questions through interviews and comments to the draft version of this document, and helped improve and address questions for which an answer was not found in existing sources. The document is meant to be a living document and remains open to additional feedback by experts and jurisdictions considered the main target audience for this work.

A key aspect to consider for the use of this Q&A is that answers should not be taken as comprehensive recipes for decision-making. For many questions, providing a concise answer implies an accuracy trade-off. Thus, this document only provides very key and high-level elements that should be further explored through a thorough review of relevant sources highlighted.

The European Commission’s Task Force for Carbon Pricing and Markets Diplomacy stands ready to provide support and guidance on carbon pricing and markets. To get in touch, please contact CLIMA-TF-CARBON-PRICING@ec.europa.eu.

1. The choice of carbon pricing as a climate policy

‘Carbon pricing instruments’ is the term used to refer to a wide range of mechanisms designed to put a price on greenhouse gas (GHG) emissions, thereby creating a financial incentive. Direct (explicit) carbon pricing refers to CPIs that apply a price incentive directly proportional to the GHG emissions generated by a given product or activity, primarily through carbon taxes or Emissions Trading Systems (ETS). Both are expected to incentivize businesses and individuals to reduce their emissions and invest in cleaner technologies and energy sources.

Under a carbon tax, the government sets a direct price on GHG emissions – the tax rate. This explicit price is usually applied to the carbon content of fossil fuel supply and expressed as a value per ton of carbon dioxide equivalent (tCO2e). A carbon tax can be applied to different fuels or sectors, and at different points of the production chain – upstream, midstream, and downstream.

In an Emissions Trading System, the government sets a limit or cap on the amount of GHG emissions of covered entities in one or more sectors of the economy, also known as a “cap-and-trade” system. These entities must surrender emission units or allowances to cover their emissions within a compliance period, which the government can auction or allocate for free – as in the EU ETS. Each emission unit represents the right to emit a certain volume of emissions – typically one tCO2e – and can be traded between covered entities or sometimes with other traders. The carbon price in these systems is usually a function of supply and demand for emission units.

Alternatively, an ETS may use “baseline-and-credit” approach, where individual covered entities can “earn” emission credits if they produce fewer emissions than the baseline. They can also be referred to as “intensity-based cap” systems, where the cap is determined as a function of a desired intensity of production processes (see Q2.3). Intensity or performance benchmarking approaches exist in jurisdictions such as Canada and New Zealand.

Carbon crediting mechanisms are another form of carbon pricing, bhttp://target-How-define-cap-ETS-What-limitations-options-different-cap-systemsut they do not in themselves create a broad-based carbon price. As with ETSs, they also involve tradable units and require a market. However, instead of ‘allowances’ (i.e. rights to emit), the tradable units are ‘credits’, which represent certified removed or reduced GHG emissions from project or program-based activities that can be sold either domestically or internationally. Credits can be used to meet compliance under an international agreement, domestic policies or corporate citizenship objectives related to GHG mitigation (see Q4.1).

Several benefits can be associated with carbon pricing instruments:

- CPIs can drive GHG emissions reductions and contribute to advance and achieve countries Nationally Determined Contributions. CPIs can deliver effective and efficient emissions reductions, as they leave emitters the choice to either pay for their GHG emissions or to adopt actions to reduce their emissions, with a view to minimise their compliance cost.

- An adequate carbon price stimulates innovation and investments in low carbon technologies and clean energy systems. It also encourages reductions in energy consumption and transitioning to low-carbon fuels. As the carbon price increases, the economic signal that triggers decarbonisation efforts can become stronger.

- Carbon pricing can provide additional development benefits, beyond mitigation. These include, but are not limited to, increased air quality, improvements in human health, employment in low-carbon industries, and energy security.

- Carefully designed carbon price reforms can also improve the efficiency of existing tax systems and ultimately enhance macroeconomic stability. They can drive more effective coverage of the informal sector in domestic resource mobilisation, reduce risks of tax evasion, increase revenue, and lead to stronger fiscal and international payments balances, as well as informing long-term investment decisions and development strategies.

- Revenues raised can support policy objectives across economic, social and environmental spheres. They can be used, for instance, to finance climate and energy purposes and a just transition – as in the case of the EU ETS and at least 14 other CPIs worldwide, and to offset potential negative impacts on vulnerable populations (See Q3.1).

But carbon pricing also presents some challenges that may deter its implementation. The main concerns include the burden on households deriving from increased prices and related distributional impacts. Another challenge may be the economic consequences for carbon-intensive industries and potential loss of international competitiveness – which may in turn result in carbon leakage. The required administrative capacity and potential political resistance also cause reluctance. The following questions and answers may offer clarity on how to address possible challenges.

Carbon prices are needed to incorporate climate change costs into economic decision-making, but they are not a silver bullet. Carbon pricing should be included as part of a broader arsenal of tools to achieve domestic climate targets. Other policy instruments and investments are needed to complement carbon pricing and to enable consumers to respond to higher prices by switching to low-emission alternatives.

A coherent set of climate policies is crucial to enhance the effectiveness of carbon pricing in reducing GHG emissions. Complementary policies – such as energy market reforms, standards, or infrastructure investments – can help limit the challenges linked to carbon pricing and address various market failures and barriers that carbon pricing alone cannot overcome. On the other hand, some policies may be overlapping or even countervailing with carbon pricing – such as fossil fuel subsidies (see Q1.5). These policies reduce the incentives of the pricing instrument and can also diminish available resources for the transition. A carbon price should operate alongside complementary policies that support decarbonization, while overlapping and countervailing policies should be consolidated, revised, or removed (where possible and appropriate).

Carbon pricing should be supported by other measures to maximise its benefits and limit potential negative impacts, particularly policies to improve access to green alternatives. Price increases due to carbon pricing will have an impact on acceptability, which can be addressed through complementary policy measures that ensure availability and affordability of green technologies. These can include providing subsidies or using carbon revenues to ensure access to green alternatives of affected households and companies.

Developing a clear understanding of policies interactions is key to realise the potential of carbon pricing to support a country’ economy in the transition.

The preferred choice of CPI may be influenced by a range of jurisdiction-specific objectives and circumstances, including economic, environmental, governance and political factors. These can include market conditions, emission targets, legal constraints, institutional capacity, and public opinion. To exemplify, a carbon tax can be effective in smaller economies where large emitters are too few to justify a trading scheme and with human capacity constraints , while an ETS may be chosen by larger economies, possibly influenced by political economy barriers to tax reform.

While the choice of instrument is dependent on jurisdictional circumstances, each instrument has its advantages. A carbon tax is generally a preferred option if revenue certainty is a priority and/or where there are institutional or technical capacity constraints. An ETS is generally preferable where achieving an emissions target is a priority and/or where there are barriers to public acceptance of a carbon tax.

Carbon taxes can have several practical, environmental, and economic advantages – especially for developing countries – i n absence of political constraints. These are due to ease of administration, price certainty which promotes investment, the potential to raise predictable revenues, and coverage of broader emissions sources. Yet, they generally face more resistance and can be politically unviable in some contexts. In addition, the carbon price under a tax system often remains low and static. This can nevertheless be mitigated by a pre-determined increase in tax rates, mirroring the scarcity effect in ETSs.

ETSs can provide more certainty over emission outcomes and garner more political support, through free allowance allocations to affected firms – although at a fiscal cost. In addition, they can unlock regional and international cooperation opportunities that could improve the cost-effectiveness of mitigation across jurisdictions. ETSs can also be designed to mimic some of the advantages of taxes, for example through price floors and allowance auctions. However, they are generally not practical in capacity-constrained contexts and are subject to price volatility which will have to be managed through price stability mechanisms (see Q2.12).

Ultimately, policymakers should choose between and within carbon pricing instruments depending on their diverse national circumstances, and as part of a comprehensive strategy. Irrespective of the carbon price instrument choice, a variety of additional measures will be needed (see Q1.3). The strategy or coherent policy package will require a balance between pricing and reinforcing instruments, complemented by extensive public communication and stakeholder consultation.

Understanding early on the interactions between the ETS and existing pricing mechanisms is fundamental. For this purpose, it is useful to start by dentifying whether these policies complement, overlap or countervail a carbon price. A fuel tax can be complementary to or overlap an ETS, while both tax breaks and fossil fuel subsidies fall under the countervailing category.

A growing body of work observes that carbon taxes and ETSs are only a fraction of the carbon costs imposed on goods. Other policies, such as fuel taxes, can provide the same incentive delivered by direct or explicit CPIs, and other energy tax reforms often accompany the introduction of carbon pricing. Focusing exclusively on direct carbon prices provides an incomplete picture of the level and the change in the broader price incentives. A total carbon price approach can be used to understand the full policy-related price signal affecting the combustion of CO2-emitting fuels.

Existing carbon taxes or fuel taxes can be complementary to an ETS, for instance by covering different sectors or entities along the value chain, but can also be used as price floors or ceilings. Under a price floor approach, a minimum price for carbon allowances is set and, if the market price for allowances falls below this threshold, governance mechanisms can step in (e.g. by removing allowances from the market or requiring emitters to pay the difference as a tax). While in a price ceiling approach a maximum price for carbon allowances is set and, if the market price rises above this threshold, the govern ance mechanisms may release additional allowances or allow firms to pay a fixed tax instead of purchasing allowances.

Fuel taxes, when overlapping, can lead to misaligned price signals and limit the benefits of the pricing instruments. In such cases, phasing-in the ETS while reducing the scope of the tax can facilitate its implementation and avoid overlaps. Existing fuel taxes can also be directly replaced with new prices in sectors concerned. For example, when Sweden introduced its carbon tax in 1991, it simultaneously reduced fuel taxes. Similarly, when Uruguay introduced its carbon tax in 2022, it simultaneously reduced its fuel tax on gasoline. These examples highlight again the relevance of a total carbon price approach.

Tax breaks and fossil fuel subsidies counteract with the ETS price signal and should be revised or, where possible and appropriate, removed, to ensure that incentives to reduce GHG emissions are not undermined. Fossil fuel subsidies should be phased out and redirected to cleaner energy alternatives. To mitigate adverse side-effects on vulnerable populations, revenues from the ETS can be recycled to provide direct support or to finance low-carbon alternatives. Policy reforms can be sequenced so that support using ETS revenues is provided before subsidies are phased-out. Fuel tax breaks can also be phased-out or at least revised, for instance they can be conditioned to low-carbon performance or compliance with ETS obligations, to encourage cleaner practices within subsidised sectors. In cases where fossil fuel subsidies and tax breaks aim to address competitiveness issues, the free allocation of allowances in the initial phases of the ETS can preserve these objectives.

A carbon price alters the relative prices of low-carbon and carbon-intensive technologies. To encourage renewables and clean technologies, the carbon price should be high enough to increase the cost of carbon-intensive technologies so that low-carbon alternatives become competitive. In addition, the carbon price trajectory should be clear and predictable over the medium term so that companies can anticipate its impact and include the cost into their economic decisions.

The impact of an ETS on the deployment of renewables and low-carbon technologies also depends on the point of regulation and on the power sector model. An ETS can be applied at different points in the power sector value chain, resulting in different incentives:

- At the generation stage: the carbon price increases fossil fuel plants operational costs, steering investments toward renewable energy

- At the dispatch stage: low-carbon energy is prioritised by the merit order, as the marginal cost of carbon-intensive power generation increases.

- At the distribution and consumption stages: it promotes the purchase of renewable energy, energy-efficiency and investments in clean-technologies.

The power sector model also influences the impact of an ETS on investments in low-carbon technologies and certain models foster innovation more than others:

- Vertically integrated utilities, often monopolistic and state-owned, determine power generation investments based on government mandates or their own interests. As they can pass on the carbon cost to consumers or return the costs to the government through fossil fuel subsidies, they have less incentive to switch from fossil fuels, especially with a locked-in fossil fuel generation fleet. Carbon pricing may increase operating costs for fossil-fuel plants but may not prompt innovation in new technologies or investment in renewables unless mandated.

- In a single-buyer model or a wholesale market, competition between multiple producers can encourage cost-competitive low-carbon investments.

Moreover, revenue generated by the auctioning of allowances can be recycled to support renewable energy projects and low-carbon technologies, reducing financial barriers to their deployment. Other complementary policies can also be implemented in parallel of an ETS to reduce other price and non-price barriers. For examples, contracts for difference, renewable energy certificates, or reforms of fossil fuel subsidies, can provide additional incentives aligned with the ETS carbon price, to encourage low-carbon technologies deployment.

Implementing an ETS in an energy market dominated by monopolistic, often state-owned utility, companies, poses specific challenges. These entities generally control significant parts of power production or distribution, influencing market dynamics and the efficacy of carbon pricing. Vertically integrated utilities, often monopolistic and state-owned, determine power generation investments based on government mandates or their own interests. A carbon price can have limited impact, especially when monopolistic utilities can pass the carbon cost onto consumers, undermining the price signal to switch from fossil fuels.

In energy market systems dominated by monopolistic companies, the scope of an ETS should extend beyond the power sector, especially in cases where the power sector is dominated by one or a few state-owned entities. A small number of participants limits market liquidity, undermining trade benefits. Including additional sectors can increase the number of participants and help to make the carbon market operational.

In addition, strong independent regulatory oversight is critical to ensure that the ETS encourages emissions reductions within the energy companies rather than burdening consumers. Carbon pricing must be reflected transparently in investment decisions and merit-order dispatch protocols to prevent utilities from prioritizing carbon-intensive generation for financial gain, which would undermine the impact of the ETS. Independent oversight and clear regulations are essential for maintaining carbon pricing signals. balance economic efficiency with consumer protection while promoting market access for low-carbon alternatives.

A shadow carbon price can be introduced in least-cost optimisation planning and in dispatch rules. A shadow carbon price is an internal price assigned to GHG emissions for decision-making purposes only, when there is no direct price associated with emissions under current regulations. It serves as a hypothetical cost to guide investments and strategies. Introducing a shadow carbon price can shift the merit order in favour of low-carbon alternatives without imposing direct costs on the system, which may facilitate the integration of the carbon price by monopolistic companies. The introduction of a shadow carbon price should be subject to independent oversight to ensure its proper application.

To enable an operational ETS, reforming the power market and subsidy systems are options to consider. An ETS regulation should align with a broader policy agenda aimed at achieving the Nationally Determined Contributions (NDCs) and Long-term Strategies (LTS) under the Paris Agreement. Including such reforms in the overall policy roadmap of an ETS helps achieve higher emissions reductions and ambitious NDCs and LTSs.

Introducing a national or a sub-national ETS is usually not a choice, but an outcome based on jurisdiction-specific circumstances. Aspects such as the political context, administrative capacity, or market size can influence the outcome. And in some cases, sub-national ETSs can be put in place as a sort of ‘pilot’ prior to the implementation of a national system.

The political context can influence the geographical scale of the ETS. Where there are strong barriers to introducing a carbon price at the national level, an ETS may garner sufficient support at a local scale. Provinces or states with a strong political commitment to climate action can push for or implement their own ETS independently. However, an ETS at the sub-national level may face jurisdictional challenges if national laws conflict with local initiatives.

The degree of decentralisation or autonomy can also favour implementation on one scale over the other. In federal systems where regions are responsible for environmental policy, a sub-national ETS may be more practical or legally feasible. In addition, the ability of sub-national units to implement policies independently allows regions with greater support for climate policy to progress more quickly.

The administrative capacity of national or sub-national jurisdictions must also be considered. A national ETS requires strong central institutions to oversee design, implementation, and enforcement, but economies of scale can reduce administrative costs relative to multiple smaller systems. On the other hand, if provinces or states have well-established governance structures, technical expertise, and sound knowledge of local stakeholders and issues, a sub-national ETS may be practical and effective.

The market size influences the operation and efficiency of an ETS. A national ETS generally creates a larger, more liquid market, reducing price volatility and increasing the efficiency of trading. On the other hand, smaller sub-national ETS markets may face limited liquidity. However, this depends above all on the size of the market and not on the geographical scale. In addition, linking between regional systems can address market size issues, as in the case of the California-Quebec initiative.

Competitiveness challenges differ depending on whether the ETS is national or sub-national. A national ETS can impact the competitiveness of domestic firms compared to other jurisdictions and create a risk of international carbon leakage (see Q3.2) but ensures a level playing field for firms across a country. On the other hand, a sub-national ETS can create a risk of carbon leakage within a country as industries or emissions may shift to non-covered regions. For example, in California the ETS covers imported electricity from other U.S. states and the Canadian and Mexican regions connected through the same electricity grid. In addition, uniform rules at the national scale can simplify compliance and reduce administrative burdens for firms operating across regions.

A sub-national ETS can act as a pilot or precursor to a national ETS. For example, China launched ETS pilots in several provinces as early as 2013, before launching its national ETS in 2021. Sub-national ETSs can be implemented more rapidly, especially in jurisdictions where climate policy has strong support, whereas a national ETS requires greater coordination and legislative support, which can take longer.

2. Design and implementation of Emissions Trading Systems

Carbon pricing is developed through a multi-stage policy processthat typically includes preparation, policy design, policy launch, implementation and review. While this process varies across jurisdictions, it consistently requires integrating stakeholder engagement and strategic communications at every stage. Whether developed independently or as part of broader climate or fiscal reforms, the success of carbon pricing depends on the seamless alignment of these cross-cutting efforts with the core policy development process.

The preparation and policy design phases generally include:

- the definition of the ETS’s scope and emissions target (Q2.2 and 2.3)

- the development of ETS regulations, legal framework, and the MRV system (Q2.4)

- the designation of the lead and supporting institutions, including regulatory authority or independent advisory entities (Q2.5)

- the setup of registry, auctioning and trading platforms (Q2.6, 2.9, 2.10)

- capacity building among administrative authorities, regulated entities, trading entities, and other service providers or stakeholders.

Stakeholder engagement begins internally to establish a shared understanding among government entities before extending to major external groups like industry, labour, consumer organizations, civil society, and academia. Consultations help refine objectives, test narratives, and gather support. Ranging from open commentary to focus groups and citizens’ assemblies, they are particularly valuable for building awareness and addressing potential opposition.

Strategic communication is essential throughout the policy development process, from design to roll-out and review. While closely linked to stakeholder engagement, a robust communication strategy extends beyond consultation, ensuring public understanding and support. This point is further developed under Q3.2.

To deliver ambitious environmental outcomes, the decision of an ETS scope and cap should consider the jurisdiction’s emissions profile, including the current level of emissions, their trend over time, and the share of emissions by sector, source, and type of emissions. It should also consider the jurisdiction’s environmental objectives and priorities.

The scope of an emissions trading system refers to the sources of GHG emissions covered, and involves a set of choices:

- Decide which sectors and gases to cover: It is usually preferable to include sectors (e.g. energy, industry, transport) and types of GHGs (e.g. CO2, methane) that account for a significant share of emissions, if they can be easily monitored, and where there is insufficient financial incentive to reduce emissions and higher potential to generate co-benefits from emission reductions.

- Choose the point of regulation: This is the stage in the supply chain where emissions are monitored, and allowances are surrendered—upstream (before the point source, e.g. fuel distributor level as in California and Quebec), “point source” (where GHGs are released into the atmosphere, e.g. installations as in the EU ETS), or downstream (after the point source, e.g. emissions from electricity used in buildings as in the Tokyo-Saitama ETS). The ideal choice balances accurate emissions monitoring, enforceable compliance, and a strong price signal to drive behavioural change, though these goals can conflict. Emissions are most accurately measured at the “point source”, while administrative costs are lower where fewer firms operate (often upstream, especially in the energy sector). Selecting the point of regulation also involves addressing carbon leakage risks, competitive distortions, and distributional effects.

- Choose entities to regulate and consider thresholds: The entities covered result from the point of regulation chosen, but thresholds can be used to reduce compliance costs for small entities, as well as lower the administrative costs of operating an ETS. However, they can also have an impact on the effectiveness of the ETS and cause competitive distortions between entities. An exclusion threshold is usually applied to smaller emitters, based on size, capacity, or annual emissions. Any threshold must be attuned to jurisdiction-specific factors.

- Choose the point of reporting obligation: This refers to who is legally responsible for complying with the ETS, a choice dependent on which entities can be held legally liable and where data is available and auditable, and often contingent to existing regulatory structures.

An ideal carbon pricing instrument should cover all GHG emission sources to maximize environmental benefits and meet targets, but this involves trade-offs. In an ETS, broad coverage can enhance market performance, increase trade gains, lower societal abatement costs, and reduce compliance and competitiveness impacts. However, it may raise administrative costs due to more entities being involved—a challenge manageable through thresholds or regulating fewer firms. Expanding to sectors with high marginal abatement costs requires caution, as it may cause significant distributional effects better addressed by other policy tools.

In practice, several ETSs have started covering emissions from coal or the power and industrial sectors, and the scope expanding over time – in some cases with hybrid approaches. For instance, the EU ETS initially covered emissions at the point source by regulating power generation and industrial facilities but has since expanded to include the aviation and maritime sectors, as well as buildings and transport through an upstream approach targeting fuel suppliers. Hybrid designs are used in many ETSs, where certain sectors are covered at the point source, while others may be covered upstream or downstream of the emissions source.

The choice of cap and its trajectory can determine the ambition of an ETS over time. The cap can be gradually reduced each year to drive emissions reductions. In addition, to give regulated entities greater predictability and encourage long-term investments, the cap trajectory should be defined over a long-term horizon, e.g. aligned with 2050 targets or the country’s NDC.

The two main options to set a cap are an absolute cap or an intensity-based cap. An absolute cap sets a fixed limit on GHG emissions over time. The cap is divided into a number of allowances per compliance period, each allowance representing 1 ton of CO2eq. The objective of an absolute cap is to reduce total emissions across sectors by limiting allowances over time. Sectoral caps can also complement an absolute cap, by setting limits on emissions by sector.

On the other hand, an intensity-based cap sets a limit on the amount of GHG emissions per unit of economic output, such as the energy generated, a production unit, or GDP. It sets a target on emissions intensity rather than an absolute ceiling on emissions– or representative of an aggregate as in the Chinese ETS. This approach provides more flexibility to accommodate economic trends or shocks. When output increases, the absolute emissions allowed under the cap can also increase, provided that emissions per unit of output remain within the intensity limit. While an intensity-based cap offers flexibility, it doesn’t ensure an absolute reduction in total emissions as total emissions can still rise if production grows significantly. An absolute cap can also offer flexibility by including a cap adjustment mechanism.

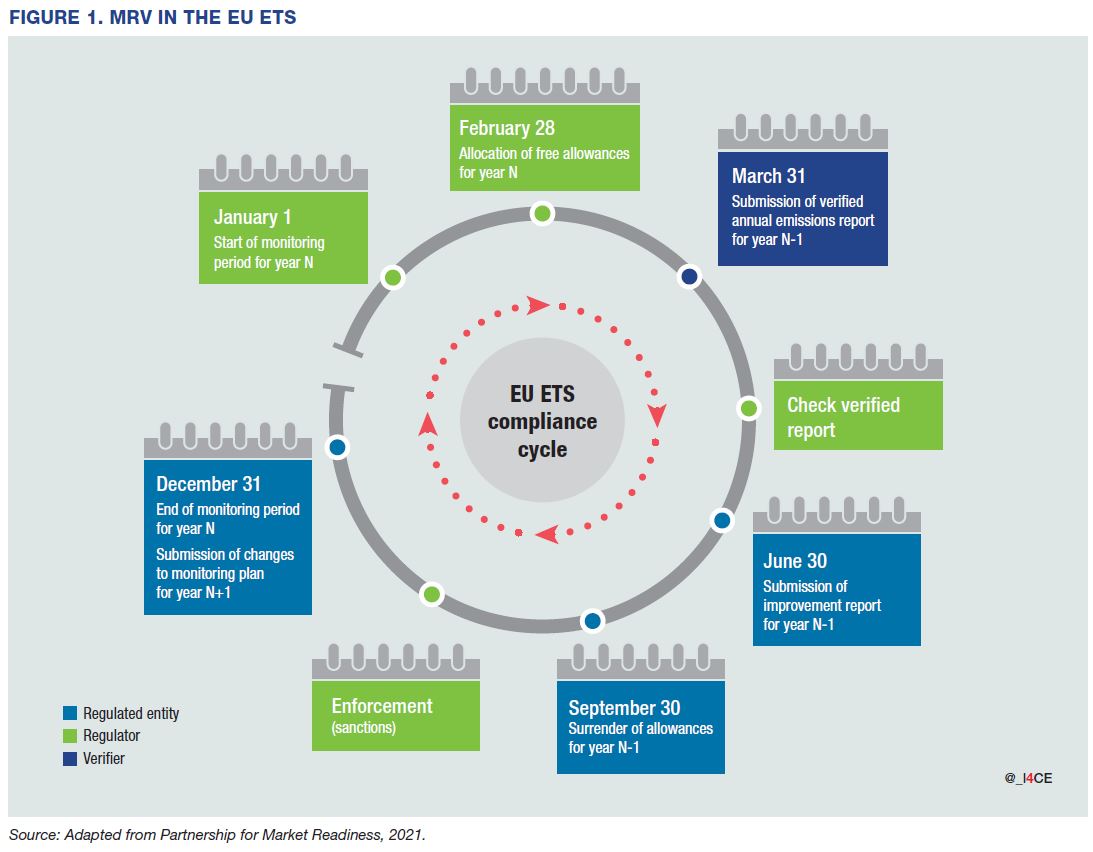

The monitoring, reporting and verification (MRV) system – including accreditation frameworks – ensures the accuracy, transparency and credibility of emissions data used by regulated entities to comply with the ETS. The MRV system and associated processes form the compliance cycle. This cycle ensures that one tonne of CO2,eq emitted equals one allowance surrendered under compliance.

In the case of the EU ETS, the compliance cycle involves three main stakeholders: the regulated entity, the regulator, and a verifying authority. It is a yearly process, part of the EU ETS compliance period as exemplified in Figure 1. Regulated entities are responsible for quantifying and monitoring their emissions, based on an approved monitoring plan. Emissions can be quantified via different methodologies (as defined in the legislation), such as through calculation methods or direct measurement. The method deployed by the entity must be indicated in the entities’ monitoring plan, on which basis entities must submit a report of the monitored emissions that requires verification by an independent party.

The verifying authority produces a verification report that states whether the reported data are accurate and compliant with the monitoring plan and legal requirements. Both the reported data and the verification report are then submitted to the competent authorities. The verification process is a key step of the compliance cycle and requires robust independent verifications. According to best practices, the regulator or competent authority conducts additional checks to validate the completeness and consistency with other data. The verified data is then used as the basis for annual process of surrendering emission allowance.

To encourage compliance with the MRV system, policy makers should provide detailed methodologies and guidance for regulators to enforce compliance of the regulated entities. These can include: methodologies for accounting and quantifying emissions, guidance on monitoring methodologies, templates for the monitoring plans and reports, rules for the accreditation and use of verifiers, and details on the exchange and management of data.

A jurisdiction can include test phases or build on existing MRV frameworks to facilitate the implementation of an ETS and lower compliance costs. For instance, Chile based its carbon pricing MRV system on its existing MRV system developed for air pollution controls. Moreover, MRV systems to be developed for an ETS could also potentially be used to feed into (national) reporting obligations to the United Nations Framework Convention on Climate Change (UNFCCC), which under the Enhanced Transparency Framework (ETF) reporting requirement will become more stringent.

In cases where MRV systems are not yet established, some jurisdictions choose to implement them gradually, giving both regulators and regulated entities time to comply. This often involves starting with voluntary reporting or a pilot phase and transitioning to a mandatory system over time. The initial phase allows both parties to build capacity and set up procedures without the risk of penalties for non-compliance during the initial stages.

A common approach during the initial stages of an ETS is to use default values instead of measuring actual emissions. The EU ETS initially relied on default emissions factors and activity data for certain sectors due to the lack of comprehensive emissions measurement infrastructure. This method allows firms to pay the approximate cost of their emissions without having to invest immediately in infrastructure for direct measurement. Although straightforward, it is important to quickly require firms to report their actual emissions, as default values do not encourage them to reduce their emissions and their cost burden.

MRV requirements need to be established at an early stage ( see Q.2.10) so that they can be communicated to the various stakeholders sufficiently in advance.

Establishing a domestic ETS requires careful institutional planning to ensure effective governance, regulatory oversight, and operational functionality. Policymakers are responsible for designing and implementing the ETS framework. To this end, a jurisdiction needs to build the necessary capacity to manage key functions such as:

- identifying and evaluating ETS design options

- drafting ETS legislation, regulations, and technical guidelines

- administering core ETS functions, including cap setting, allocation, monitoring, reporting, verification, enforcement, verifier accreditation, registry, and record keeping

- monitoring the trading market to prevent market abuse and manipulation

- managing ETS fiscal implications and impacts on other government policies, measures, and administrative systems

- communicating to the public and relevant stakeholders

The respective responsibilities of different ministries, regulatory authorities, implementing or technical agencies and other actors taking part in the design, implementation and enforcement of an ETS, need to be clearly set out in legislation. In several jurisdictions, the Environment Ministry has generally led the implementation of the ETS, but some new forms of governance arise . In practice, governance is divided between several institutions according to each jurisdiction’s specific context.

To build capacity, a jurisdiction can rely on existing ETS materials and tools from other jurisdictions and organisations. Several jurisdictions have used carbon market simulations when developing an ETS, which are programmes that allow stakeholders to take part in a fictional process of designing or participating in an ETS. Moreover, capacity building remains relevant beyond the ETS implementation phase, as the instrument can evolve over time.

Human resources capacity needed to establish an ETS depends highly on the national context and ETS design and will evolve over the development of the ETS. The development, the implementation, and the operation of the ETS each require specific human resources capacity. Resource needs may increase as the ETS scales up, especially if new sectors or participants are added.

An ETS registry is an online database designed to issue, record, track and retire the allowances that are allocated, auctioned, or traded. It serves two main functions: determining the number of allowances held by each account holder and track transactions of allowances between participants.

Registries offer reliable data on emissions reductions, transactions, and enable regulated entities to demonstrate compliance by aligning the allowances they hold with their verified emissions. Accurate accounting of allowances is essential to guarantee the environmental integrity of the ETS, in particular to prevent “double counting” by ensuring each allowance is uniquely tracked and only used once for compliance purposes.

Setting up a registry requires the development of legal, technical and institutional frameworks. The legal framework should define administrative terms and conditions to open, close and access an account for the emitting entity. Legislations should also cover the interaction with the auctioning platform, data protection and confidentiality, the definition of the legal nature of carbon units (whether it is a good, an administrative grant, a financial instrument, a property title, etc), tax implications of the trade of carbon units, and the rules governing the insolvency of account holders. In addition, the legislative framework must be robust enough to support automated processes and international linkages, if applicable.

The technical infrastructure of the registry can be either shared with other jurisdictions, developed from scratch, adapted from existing registries, or outsourced to a private service provider. Choosing to use the services of an IT company has its advantages and disadvantages, and the final decision must consider factors such as the cost of maintenance, the complexity and flexibility of the system, and data ownership. Registries are exposed to various security risks. Adopting the best practices in terms of security measures is essential to mitigate these risks.

The administration of the registry includes both management processes, such as staff and budget management, and operational processes, such as monitoring users and operations. The administration can be handled either internally, by a public authority, or externally, by a third party. Environment or energy department are commonly the designated public authority in charge of the registry’s implementation. If the administration is outsourced to a third party, adequate oversight should be provided to maintain integrity and compliance with regulations. The choice depends on the regulatory framework, technical expertise available, and administrative capacity. A combination of both approaches may also be used, with the private sector handling technical operations under the supervision of public authorities.

Jurisdictions worldwide use different terms to refer to the compliance tradable units of an ETS. Compliance units are generally referred to as ‘allowances’ but are also often called ‘permits’ in the literature. In Canada, compliance units are called ‘credits’, although they are not to be confused with carbon credits (see Q4.1).

Although they are often used as synonyms in the literature, the terms ‘permit’ and ‘allowance’ have different meanings and obligatory implications in the case of the EU ETS.

A permit refers to the authorisation granted to an entity (usually an installation) to operate its activities and emit GHGs, and therewith sets the obligation to participate in an ETS. Every regulated entity needs to acquire a permit from a competent authority to legally operate within an ETS. In the case of the European Union, for instance, this is clearly stated in articles 4-6 on greenhouse gas emissions permits of the Directive 2003/87/EC of the European Parliament.

Allowances refer to the traded units of an ETS, representing the right to emit one ton of CO2 or equivalent GHG. Allowances can either be allocated for free, auctioned, or purchased from other regulated entities. Every regulated entity must surrender allowances equal to their emissions over a fixed compliance period. If an entity emits more than its allowances, it must buy additional allowances on the market or will face penalties for non-compliance. If an entity emits less than its allowances, it can trade the surplus of allowances on the market or bank them for future use.

In the EU ETS, regulated entities must hold both a permit and sufficient allowances to cover their emissions for each compliance period.

The two main options to allocate allowances are free allocation or auctioning of allowances, which can involve diverse methods in the case of the first, and the two can be combined. Each method involves trade-offs against achieving one or more policy objectives.

Free allocation involves providing emissions allowances to regulated entities at no cost, typically using one of two methods . The grandfathering method provides allowances for free based on historic emissions, offering simplicity and compensating for stranded asset risks but risking windfall profits, weak protection against carbon leakage, and penalties for early action. The benchmarking method, by contrast, ties allocation to emissions intensity benchmarks of a sector or product, rewarding efficient entities while penalizing less efficient ones. While free allocation addresses competitiveness and carbon leakage concerns and builds political support, it can delay low-carbon investments, surrender revenue recycling benefits, and should serve as a transitional tool while preparing for auctioning or advanced allocation methods.

Auctioning of allowances is a method by which regulated entities purchase at auction the number of allowances they need to cover their emissions. This generates revenues for the government or jurisdiction, that can be earmarked for climate-related expenditures or recycled to compensate low-income households or firms facing losses of competitiveness. Auction revenues can also go into the general budget. Auctions can also play a role in providing market liquidity and price transparency.

In practice, jurisdictions often rely on a combination of free allocation and auctioning. An ETS may first opt for free allocation and lower the cap while gradually increasing the share of auctioned allowances. Full auctioning is rarely used in the initial phase of an ETS, but jurisdictions tend to evolve toward more auctioning and less free allocation over time.

To set up the auctioning platform, a jurisdiction must define the objectives and format of the auction. The choices depend on the size of the market and the type of participants. The format includes:

- the frequency and schedule,

- price determination,

- the bidding format.

A jurisdiction must also establish the legal and regulatory frameworks, which include the rules for auction participation, the bidding procedures, the publication of information, and market misconduct laws. The auctioning platform requires a secure, reliable and scalable IT system to conduct auctions, process bids and manage payments. Features like participant registration, bid submission, and auction results dissemination must be included within the platform. In addition, the platform can be linked to the ETS registry, for automatic allocation of the auctioned allowances to account holders in the registry. A jurisdiction can also build on existing platforms. For example, auctioning can be facilitated by and integrated to other trading platforms, such as the European Energy Exchange (EEX) in the case of the EU.

The rules and structures that govern the secondary market play a key role in making allowance trading operational. Under-regulation and insufficient oversight can expose the market to risks of fraud and manipulation, while over-regulation can drive up transaction costs and limit entities’ access to financial risk-management tools.

The secondary market legal framework must define: the participants (for instance if financial institutions are allowed to enter the market), a regulator (in charge of overseeing the market), what can be traded (for instance if allowances are traded as financial securities or if derivatives of the allowances, such as contracts for future sales of allowances, are allowed), and other rules affecting the market’s security, stability, and vulnerability to fraud. Oversight rules should be developed at the inception of an ETS, and compliance should be strictly monitored. The legal framework is key for facilitating market trading and maintaining balance between the legal rights of buyers and sellers of allowances through well-defined contractual agreements, data transparency and dispute resolution mechanisms. Similarly, as for the auctioning process (see Q2.9), a trading platform must be developed, which can be linked to the registry. A jurisdiction can build on existing trading platforms and financial market oversight regulations.

Gradual phase-in allows learning by doing and aims to manage complexity by building capacity and addressing potential challenges over time. Generally, a final ETS design is planned from the start, and the implementation evolves towards the application of that intended policy design. The initial phase of the ETS can be a pilot phase with a view to gather and test systems (see Q2.12).

The main objectives of gradually phasing in an ETS are:

- to build capacity, both within administrative authorities and regulated entities, and to build confidence in ETS operational systems

- to implement a carbon price at an early stage, without waiting until all the ETS elements have been defined

- to reduce initial implementation costs

- to allow time to adjust regulatory frameworks.

Among major design features of the ETS that can be gradually implemented are:

- the number of sectors covered, which can be expanded over time (or if some sectors start with reporting obligations only) and emissions thresholds above which entities are regulated, potentially targeting higher emitters first

- the cap on emissions, which can be reduced to increase ambition over time

- the use of free allocation, which can be phased out progressively

- price or supply adjustment measures that control the price level, which can be relaxed over time

- MRV regulations, which can become increasingly robust

- linking the ETS with ETSs from other jurisdictions, which can be implemented at a later stage once the ETS is well established.

In addition, the distinction between different phases can also be extended beyond the gradual implementation of the ETS, as the system becomes more mature, and adjustments are made to improve its efficiency over time.

> The EU ETS is currently in its 4th phase. The first phase (2005-2007) consisted of a 3-year pilot, during which almost all allowances were given for free. During the second phase (2008-2012), countries had concrete emissions reduction targets to meet, the cap and share of free allocation were reduced. In the third phase (2013-2020) the system changed considerably, becoming a single EU-wide cap on emissions, and auctioning became the default method for allocation allowances.

An ETS pilot is a time-limited trial program designed as a testing and learning period, as part of the implementation process of an ETS. Jurisdictions often start with an ETS pilot, in addition to, or instead of, gradual implementation. The objectives of ETS pilots are to:

- test ETS policy, methodologies, systems, and institutions, in particular identify potential problems, conflicts with existing legislation, the need for new legislation, or the need for improved market oversight

- collect data for the establishment of further regulations, e.g. allowance allocation, and facilitate learning related to data collection and reporting and database management

- build capacity within governing institutions, as an ETS pilot requires actual implementation of the legislative, institutional and technical frameworks, including preparing guidance documents from lessons learnt, and build capacity within market participants, allowing them to anticipate and prepare their technical arrangements for measuring emissions and complying with the ETS process

- demonstrate effectiveness, in particular test ETS outcomes and overall impact.

Policymakers need to carefully design the ETS pilot, to provide a clear understanding of the legislation and market processes, while limiting costs and complexity, in line with the objectives of the pilot phase. Design features depend on the specific objectives of the pilot phase and must include: the length of the pilot, the coverage, the allocation method, the cap stringency, the enforcement rules, and the choice to allow or not the banking of allowances for the future ETS.

Allowances in carbon markets are rarely traded directly between regulated entities, as transaction costs to identify trading partners and agree on the terms and prices can be high, and this type of trade provides very little information on demand and supply and market trends and outlooks. Trading is instead often conducted through financial service providers, acting as intermediaries, risk-managers and profit-seekers.

Non-compliance players such as financial institutions can bring substantial benefits to carbon markets. They facilitate trade between liable entities and add market liquidity by increasing the number of market participants. They support information flows and contribute to more accurate allowance prices that better reflect market conditions and supply and demand trends. They also provide risk-management products to help regulated entities face price and volume risks.

Financial institutions also help to reduce price volatility and provide a source of supply or demand of allowances to regulated entities. They engage in arbitrage, buying under-priced instruments to sell them at a profit, and take long-term positions in carbon markets regarding future prices, driving prices up or down and generating intertemporal substitution.

However, opening up the ETS market to non-compliance players adds complexity and requires increased oversight to monitor and manage trading activity, preventing potential market abuses. The participation of financial institutions results in carbon markets operating more like financial markets. Transparency and reporting requirements are essential to ensure that their participation is beneficial to the trade of allowances and doesn’t distort prices or diverts the focus to short-term profits. A jurisdiction can draw on its existing laws and regulatory frameworks for trading financial products so that new rules aren’t necessarily required. Nevertheless, financial institutions are sometimes excluded from carbon markets during the ETS pilot phase, to limit complexity and prevent market abuse.

Price volatility under an ETS refers to significant and unpredictable fluctuations in the price of emission allowances. This can be driven by various factors, such as economic cycles, shifts in energy demand, technological changes, or regulatory uncertainties. Although price fluctuations over time are desirable to transmit information on costs to reduce emissions, excessive price volatility represents a challenge for both regulated entities and policymakers which undermines the predictability needed for long-term climate action. Prices falling too low can reduce investment in low-carbon technologies, while overly high prices can have negative economic, social and political impacts.

Mechanisms to limit allowance price volatility under an ETS can include, but are not limited to:

- Price floors: create a baseline that prevents prices from falling too low, ensuring continued incentives for emissions reduction and stability for investments. They can be applied by specifying a minimum price at allowance auctions. This mechanism tends to raise revenues.

- Price ceilings: can be used if there are concerns about the risks of high emissions prices. They prevent excessive cost burdens on regulated entities, especially during high-demand periods. This can be done by allowing regulators to release additional allowances when prices approach the cap or a trigger level. This mechanism tends to limit revenues.

- Market stability reserve (MSR): automatically adjusts the supply of allowances based on market conditions. If there is a surplus of allowances, some are withheld from the market, reducing supply and stabilizing prices. Conversely, if allowance prices rise sharply, the reserve can release additional allowances, easing price pressures.

In the EU ETS, the MSR was introduced during phase 3, and contributed to soften price fluctuations to provide predictability without interrupting the market-based system, and maintaining the price trend in line with the cap.

- Back-loading of allowances: approach aimed to rebalance supply and demand, reducing volatility without significantly impacting competitiveness.

- Banking and borrowing: creates flexibility as entities can hold allowances when prices are low and use them or sell them when prices rise. Yet limiting the number of banked allowances or setting expiry dates on banked allowances is needed to prevent entities from hoarding large volumes, which could distort supply-demand dynamics and cause price volatility.

- Scheduled auctions: releasing allowances at regular intervals prevents large volumes from entering the market at once, which could lead to sudden price drops.

- Reserve price in auctions: setting a minimum price in auctions helps ensure allowances are not sold below a certain threshold, preventing excessive price drops.

- Excessive price increase mechanisms: triggered when prices exceed a certain level. For example, when prices hit a pre-set threshold, additional allowances may be released from a reserve, or entities may be allowed to use offsets to cover a portion of their emissions at lower costs.

- Linking with other ETS markets: linking an ETS with other systems, such as California’s and Quebec’s linked markets, creates a larger pool of allowances and market participants, which increases liquidity and reduces price volatility. If prices rise in one region, allowances from the linked market can be used, balancing prices across the systems.

- Multi-annual compliance period: gives entities more time to adjust, reducing the need to purchase allowances during short-term price peaks.

- Market surveillance: continuous monitoring of the ETS market by regulators can detect unusual trading activities or price spikes that indicate market manipulation. Transparent reporting requirements and active oversight prevent speculative behaviours that could drive volatility.

- Intervention authority: granting regulatory bodies the authority to intervene during extreme price swings can stabilize prices if other mechanisms fail.

3. Economic and social implications

Market-based climate mitigation policies often raise concerns about potentially adverse impacts on vulnerable population, which could severely undermine the political feasibility of these policies. This is particularly true in the case of environmental taxes, which have faced resistance in several contexts. However, studies on distributional impacts of carbon pricing have arrived at ambiguous results, showing that these are largely contingent to a variety of often country-specific factors.

Distributional impacts refer to the extent to which there are differences in socio-economic impacts of interventions across different groups in society. Their magnitude depends on sectoral and spatial distribution of costs, to what extent costs are passed through – to consumer prices or other companies, and to what extent and how are compensation or protection measures taken. In countries where all income groups use fossil fuels and/or fossil fuel-based electricity, policies that increase the cost of energy generally have a negative impact, disproportionately affecting lower income households.

Carbon pricing can have more equitable outcomes if potential distributional impacts are addressed as early as at the design stage, using tools such as ex-ante assessments. This is particularly relevant for policy makers in lower-income countries, but not only, so timely decisions can be made on possible policy options to prevent them. A thorough ex-ante assessment of distributional impacts, utilizing tools like the Carbon Pricing Incidence Calculator (CPIC), can help identify the most affected households.

Another effective strategy to address distributional impacts involves pass-through restrictions in legislation, which limit how much of the carbon price can be directly transferred to consumers in the form of higher prices. By regulating the extent of cost pass-through in critical sectors, such as transport and energy, governments can reduce the immediate economic burden on households while maintaining incentives for emissions reduction. Pass-through restrictions may be particularly beneficial in low-income and rural areas, where energy costs comprise a larger share of household budgets and where infrastructure for clean alternatives is still limited. However, these restrictions must be complemented with long-term investments in energy efficiency and clean energy infrastructure to ensure a sustainable transition.

Suitable revenue recycling schemes can address the risk of potentially increased consumer prices to mitigate the risk of increased poverty for low-income households and enable a just transition. Revenues can be used to compensate and support the transition of poor households, for social welfare programs, for public investments in infrastructure, for providing access to water, sanitation, electricity, telecommunications and transport. Combining climate policies with a targeted use of revenues is thus one of the strategies with potential to simultaneously mitigate climate change, prevent potential negative distributional impacts and address additional sustainable development goals.

Cash transfer programmes in low-income countries can help address distributional concerns and generate additional benefits, yet the challenge of reaching lower-income households must be acknowledged. In Uganda, lump sum transfers could over-compensate 75 per cent of the population for welfare losses due to carbon pricing, yielding net welfare gains. Alternative strategies, particularly for low-income countries, can include providing subsidies for cleaner cooking –which may prove beneficial in promoting a clean energy transition and reducing indoor air pollution, yet accompanied by strategies to address potential trade-offs –such as exempting cooking fuels from carbon pricing while promoting clean fuel use through other economic incentives.

Addressing challenges related to social perception and acceptability of carbon pricing requires consideration of a comprehensive set of strategies as early as at the stage of policy design. Several strategies can be used at this stage, including an incremental approach to the implementation of carbon pricing well embedded in the broader (climate) policy mix, choosing the right timing for interventions (e.g. related to fuel prices), and using revenues effectively and fairly. From the design phase, communications should also be thoroughly embedded to improve social acceptability.

Good communications require good policy. Communications planning on carbon pricing should begin early, ideally in parallel with the development of the policy itself and the consideration of how to use the revenue. During the preparation phase, having a communications specialist in the working group or task force put in place for policy development can make a difference. This actor should be involved in all subsequent phases of policy design, development of messaging, policy launch and policy review.

Policymakers should engage in early discussions with a wide range of stakeholders to assess political support and develop an effective communications strategy. This can build acceptance across the government and externally with the private sector and civil society. Opinion surveys, focus groups, and other forms of market research can be useful tools for understanding public opinion.

Before the policy is launched, the messaging should be prepared considering feedback gathered from stakeholders. Specific narratives can be used to frame communications on carbon pricing, The Guide to Communicating Carbon Pricing highlights three that have worked well: fairness, balance, and shift to clean energy; alongside others that have been less effective: cost, expert consensus, and threat of climate change. Yet the effectiveness of messages is highly specific to the audience, culture, and national context within which they are used, and thus audience testing is essential, for instance health reasons of pollution could be a factor to tackle in communication campaigns.

Clear and relatable messaging is essential to convey the purpose and benefits of carbon pricing, and it can be achieved using several strategies. Some of them include:

- Simplifying complex information using straightforward language to explain how carbon pricing works and its advantages.

- Highlighting co-benefits such as economic growth and public health improvements.

- Addressing misconceptions by proactively correcting misunderstandings and providing factual information.

Once the policy is in place, stakeholders should be kept informed of outcomes and be involved in policy review and adjustments. Communications should promote clear examples of outcomes, and the policy should include mechanisms for evaluating its effectiveness. Regulators in several jurisdictions such as California and Québec regularly disseminate implementation results, such as compliance rates, collected revenues, and the use of those revenues.

Trust is critical. Evidence shows that the response to carbon pricing is often a reflection of wider issues of trust in government and business, and their perceived accountability. If trust in the government is low, the public may be less likely to trust government explanations of carbon pricing policy, including on revenue use. Key design elements can help increase trust, such as a strong MRV and a transparent use of revenues.

In some jurisdictions, the use of revenues should be the dominant narrative. When communicating carbon pricing, messaging can easily get filled with complex and highly technical arguments. Using a revenue use narrative can be an effective strategy, particularly in contexts where narratives around negative impacts of carbon pricing can be easily used for political purposes in times of elections.

Carbon pricing operates as part of a broader fiscal landscape that requires consideration of complex relationships and trade-offs. Government objectives in the fiscal context often include consideration of efficiency, equity, and long-run growth. The circumstances are no different when exploring the different options for carbon revenue use.

The use of revenues is one of the key design features with potential to influence social perception and acceptability of the carbon pricing instrument. Some studies suggest public support is higher when revenues are given specific purpose, as this allows the public to see clearly what they are funding. Moreover, studies have found people are more likely to accept a carbon price when revenue use is aligned with their preferences and consistent with the goals pursued with the policy. But public preferences remain context dependent, and beyond specific uses, features of the overall process should be considered.

Policy makers are confronted with a chain of decisions when determining the use of carbon revenues, which will have implications in terms of public support. This chain can be seen as a four-step process, similar to the policy: 1) defining the purpose (e.g. for climate objectives), 2) defining the how (e.g. to channel them through the budget or a special purpose fund), 3) implementing choices, and 4) assessing outcomes (e.g. to report yearly on use of revenues, carry out ex-post evaluations to assess effectiveness and parliamentary oversight over outcomes).

Definitions on the purpose pursued with revenue use would benefit from input from a wide range of stakeholders. Everyone will want a piece of the pie. But the decision should be coherent with context specific needs and priorities and avoid compromising effective decarbonisation efforts.

The decision on how and to whom distribute carbon revenues should be based on country contexts and priorities, with careful consideration of several key criteria including:

- Economic Efficiency: allocating funds to initiatives that maximize emissions reductions is crucial. Investing in renewable energy projects, energy efficiency programs, and technological innovations can yield significant environmental benefits, while at the same time enhancing overall economic efficiency.

- Environmental Effectiveness: revenues could be directed toward projects and policies that contribute to long-term emissions reductions. This includes funding for sustainable infrastructure, research and development in clean technologies, climate projects or conservation efforts. Such investments can amplify the environmental benefits of carbon pricing and promote public support under the logic of ‘thematic matching’ – matching the aim of a fiscal policy and the use of its revenues.

- Equity and Fairness: ensuring that vulnerable populations are not disproportionately burdened by carbon pricing is essential. As discussed in Q3.1, revenues can be redistributed to offset increased costs for low-income households, either through direct rebates or by funding social programs. This approach helps maintain social equity and public support for carbon pricing policies.

- Political Acceptability: the success of carbon pricing schemes often depends on public and political support. Transparent and fair distribution of revenues can enhance acceptability. For instance, returning revenues directly to citizens can increase public approval and trust in the system, but only when properly communicated and better if backed by assessments to prove positive impacts.

- Administrative Feasibility: trade-offs between different channels to distribute revenues should be assessed, as each option can have its pros and cons. For instance, using the general budget is simpler from an administrative perspective but can be less transparent and not optimal to ensure public support. Special-purpose funds are more complex to set up and manage but provide more transparency and visibility.

Balancing these criteria is essential to ensure that carbon pricing revenues effectively contribute to climate goals while maintaining economic stability, social equity and ensuring public support.

When deciding on institutional arrangements for revenue use, there is a need to assess trade-offs between different options considering possible impact on social perception. The use of the general budget as a channel is a legitimate choice often supported by claims of flexibility and efficiency, yet it should be coupled with tools such as green budgeting to avoid it becoming a sort of black box. A wide array of options including special-purpose funds, the tax system or even the social security system should also be considered and analysed contrasting pros and cons.

Finally, transparency and accountability are crucial for public acceptance, and visible use of carbon pricing revenues showing concrete positive impacts is often key. Using revenues as planned and reporting on how they have been used is a good way to increase trust. But this needs to be coupled with ex-post evaluations to assess the outcomes of those decisions and oversight mechanisms to ensure accountability.

Carbon pricing can impact the competitiveness of sectors covered, especially in energy-intensive and trade-exposed (EITE) industries. These impacts can be reflected in cost increases, carbon leakage – the relocation of production to jurisdictions with less stringent carbon policies, and export challenges. Yet empirical evidence in G20 countries shows that concerns about negative short-term effects on competitiveness have not come to pass in most cases, and when they happen, such effects tend to be small. Still, unequal carbon prices across countries can create an unlevel competitive field.

While the development and strengthening of carbon pricing systems in jurisdictions globally contribute to a level field for climate measures, several mechanisms can be used to mitigate impacts on competitiveness in the design of an ETS:

Free allocation of allowances: this is a common approach for addressing competitiveness concerns under an ETS. It entails distributing allowances at no cost to industries at risk of carbon leakage. The equivalent for carbon taxes would be tax rebates and exemptions. The aim is to reduce compliance costs. Free allowances can still maintain incentives for emissions reductions for instance when following a benchmarking approach based on the best performance of installations.

Border carbon adjustments (BCAs): carbon leakage pressures that may rise with greater carbon price disparity between countries and can be mitigated using BCAs. These can take the form of allowance purchase requirements for imports.

On 1 October 2023, the CBAM entered into application in its transitional phase and full implementation will start in 2026. This gradual introduction of the CBAM is aligned with the phase-out of the allocation of free allowances under the EU ETS.

- Recycling carbon pricing revenues: using revenues raised from carbon pricing instruments to support industries, innovation, or consumers can help address competitiveness concerns. These resources can be reinvested in innovation, research and development, low-carbon technologies, or to offset higher production costs.

- Output-based rebates (OBRs): provide financial compensation or emissions allowances to regulated entities based on their level of production rather than historical emissions. Rebates are tied to the output of the facility and are calculated using a predefined emissions benchmark (e.g. average emissions intensity of the sector). This mechanism rewards improvements in emissions intensity – lower emissions relative to the benchmark, providing cost advantages.

However, when considering policy design to address business competitiveness and leakage, policy makers must be careful not to introduce suboptimal policy design that undermines the overall effectiveness or efficiency of the carbon pricing instrument. Compensation to industrial sectors should be targeted to those that truly need protection, based on data-driven evaluation, and should not exceed the share of carbon costs that are retained by the company and not passed on to customers.

As a non-EU country, having a recognized carbon pricing scheme can indeed facilitate exports to the EU by reducing the adjustment required by the Carbon Border Adjustment Mechanism (CBAM). To ensure a country’s scheme aligns with CBAM requirements and supports export viability, the following aspects should be considered:

- Demonstrating Equivalence: The EU CBAM ensures that a carbon price effectively paid on the emissions embedded in the imported goods will be deducted from the CBAM obligation. This design ensures that a carbon price is not paid twice on the same emissions. While the evidence required to demonstrate a carbon price will be defined in a forthcoming implementing act, the Regulation considers both allowances under an ETS and explicit carbon taxes as eligible.

- Participation in the Transitional Phase: During the CBAM’s transitional phase (October 2023 to December 2025), exporters are required to report embedded emissions and any carbon price paid in the country of origin. These reports will be critical for refining methodologies and ensuring smooth implementation when certificate requirements begin in 2026. During this period, no certificates need to be surrendered, but accurate data submission is crucial to inform the further implementation of the CBAM by the European Commission and adjusting to the requirements before the post-transitional period starts in 2026.

- Collaboration and Registry Participation: As from 2025 installation operators outside the EU can upload and share their installations and emissions data and information on the carbon price paid directly in the CBAM registry, instead of submitting the data to each declarant separately.

- Emissions Calculation and Default Values: Until 2024, companies can use default reference values for emissions reporting. However, establishing mechanisms to calculate and verify actual emissions compatible with requirements under the CBAM is recommended for long-term compliance and minimising the adjustment.

- Capacity Building: Depending on the type of carbon pricing instrument, developing the institutional and technical capacity to implement robust MRV systems supporting an ETS/tax and effectively levying of carbon taxes on emissions released in the sectors in scope.

For developing countries, an important consideration is that the current scope of CBAM does not generally make them the most affected by the measure. The CBAM regulation mandated the European Commission to conduct a report to the European Parliament and Council before the end of the transitional period in 2025 on the impact on developing countries. Moreover, guidance and self-assessment tools developed by both the EU Commission and the World Bank are currently available. Yet the exact rules on how (and which) third-country carbon prices can be recognised and deducted from CBAM payments are due to be finalised by end of 2025.

4. Connecting with crediting mechanisms

Carbon credit markets principally trade carbon credits –instead of allowances– meant to rep resent GHG emissions reduced or removed through climate change mitigation activities. These activities could be mitigation projects –such as solar or wind energy generation, energy efficiency improvements, or emission removals by sequestering carbon –such as by permanent nature-based solutions or direct capture and storage. One carbon credit is, in principle, equivalent to 1 tCO2e and can be traded in carbon markets, generating finance for the respective project.

There are three main categories of crediting mechanisms:

- International crediting mechanisms: established with international agreements and could be managed by international bodies (e.g. the Clean Development Mechanism (CDM) under the Kyoto Protocol, which is being replaced by the Article 6.4 mechanism under the Paris Agreement, or the CORSIA carbon market regulated by the International Civil Aviation Organization (ICAO)).

- Governmental crediting mechanisms: embedded in national law and administered by governments (e.g. Californian Compliance Offset Program and Australian Carbon Credit Unit). For this purpose, countries may draw out a national carbon market framework or legislation for criteria and standards of credit projects. The generated credits are traded domestically or linked to international transfers.

- Independent crediting mechanisms: include those administered by a non-governmental organisation (e.g. Verra and Gold Standard). The generated credits can be used by private entities to offset their emissions and meet their voluntary mitigation commitments (although under the Paris Agreement mechanism, few credits are suitable for voluntary offsetting due to the risk of double claiming), as well as for compliance purposes in certain jurisdictions (e.g. in Chile domestically generated credits can be used to offset tax liabilities).

To ensure the effectiveness of carbon crediting mechanisms in reducing emissions, robust quality standards for high social and environmental integrity are pre-requirements. Such standards should include criteria such as additionality, permanence, double counting, robust and conservative quantification, benefit sharing, human rights safeguards, etc. Depending on the category of crediting mechanism, the standards are set internationally, nationally, or by voluntary standard setting bodies.

Crediting mechanisms can be a valuable tool for mobilizing finance, but they are not a standalone solution, and both opportunities and limitations of different approaches should be considered. Their effectiveness will depend on the design, implementation, and alignment with broader climate policies and goals. Moreover, choices on the approach will have different implications and outcomes, and potential trade-offs should be assessed keeping in mind national objectives, sectoral readiness and market dynamics.

On the opportunities side, crediting mechanisms can promote and provide:

- Investment opportunities that can attract financial flows from a broad range of actors, domestically and internationally – including in the form of results-based finance.

- Private sector engagement, offering financial incentives for mitigation projects and leveraging private funding that may not otherwise flow into climate projects.

- Cost-effectiveness, allowing countries or companies to finance mitigation where it is most affordable.