The adaptation of real estate: what roles can the financial sector play?

Initial overview and insights on banks, insurers and asset managers

The need to clarify the role of banks, property insurers and asset managers in real estate adaptation

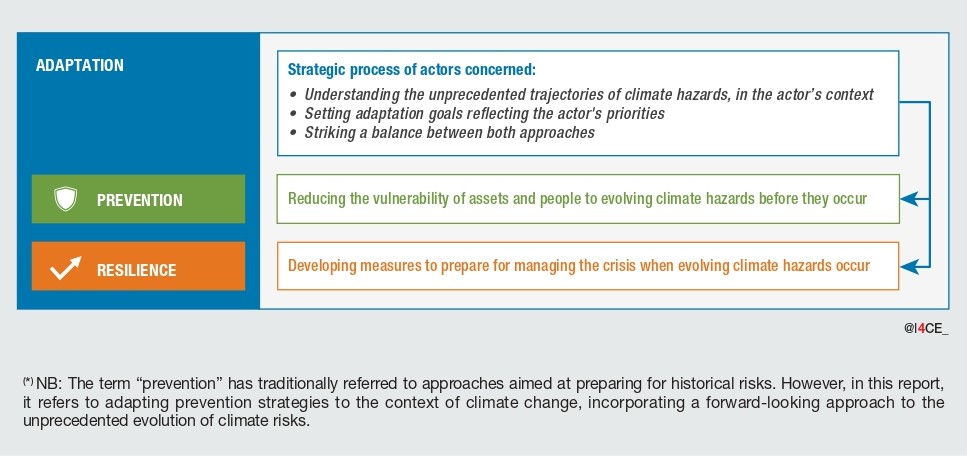

As the effects of climate change become increasingly evident, stakeholders in the real estate sector must prepare for the consequences of global warming, which could reach +4°C in France by the end of the century. The challenge for the real estate sector ranges from preventing climate-related damage to building resilience in times of crisis.

This raises the question of how the costs of adaptation will be covered. It is currently estimated that these costs amount to at least billions of euros per year for heatwaves alone, to which are added the costs of adapting to floods and the shrinking and swelling of clay soils. As the use of public finance tools becomes increasingly restricted, questions arise regarding the potential role of commercial financial actors, alongside public actors, households and businesses.

This exploratory report aims to lay the groundwork for a dialogue on the potential role of commercial banks, property insurance companies and asset management firms in supporting investments for real estate adaptation and providing appropriate financial services. It draws on initial testimonies from financial institutions and real estate professionals in France, as well as a literature review.

In the context of its capital provision activities, the financial sector could be expected to support real estate stakeholders in their adaptation efforts

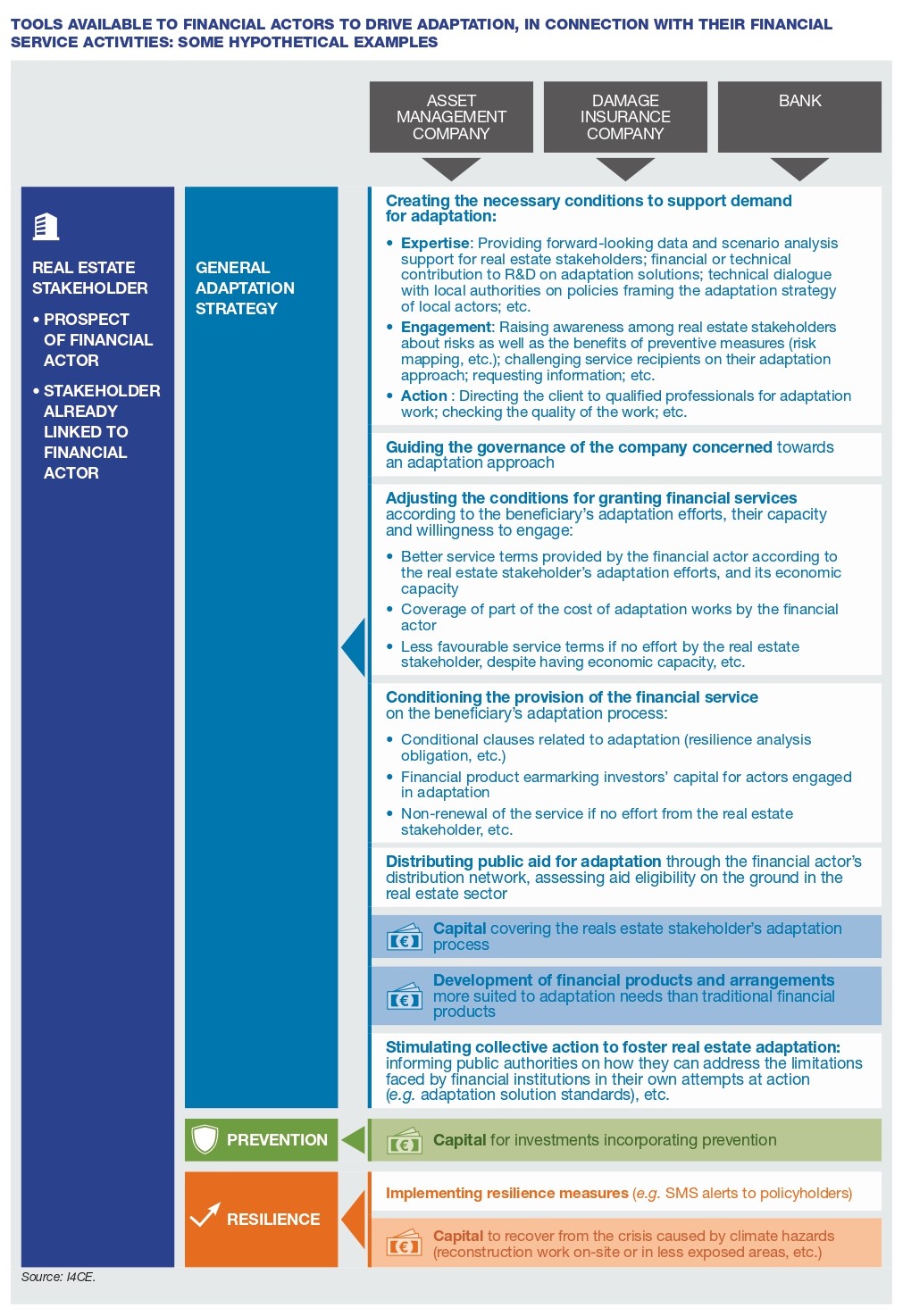

Financial actors may see an interest in real estate adaptation, both in terms of market opportunities and in terms of limiting their own risks. For example, the profitability of a real estate company’s shares could decrease if it falls behind its peers on adaptation issues.

Banks, insurers and asset managers have several tools at their disposal to support real estate stakeholders in adaptation. In the context of providing financial services (loans, promises of compensation in case of damage, investment), they can influence the entire adaptation process of real estate stakeholders, as illustrated below.

In practice, the financial sector has so far shown limited momentum in real estate adaptation

While there are mixed responses from asset management firms, banks are generally less advanced and tend to defer the issue to insurers. Insurers, on the other hand, are aware of the importance of prevention for their business, which is primarily focused on resilience. However, at this stage, their action to support prevention is more about raising awareness among policyholders than taking on the costs of necessary actions Where resilience is concerned, public policy is essential to ensure the solidarity objective of the French public-private Cat Nat scheme and the involvement of insurers.

Several trends could explain why this subject is struggling to gain traction among financial actors

Many French banks and some asset managers have yet to fully explore the commercial opportunities of real estate adaptation, as they do not spontaneously see an interest in it. Furthermore, real estate stakeholders themselves have not yet generated demand for adaptation-related financial services, having struggled from the outset with the development of an adaptation strategy. Financial actors are also ill-equipped to support real estate stakeholders in developing their adaptation strategies. Thus, adaptation often loses out in the financial institution’s priority setting.

More specifically in the case of banks, their approach to climate issues has centred around financial risk management, particularly in real estate. This has not yet motivated them to engage in adaptation. This can be explained by an initial focus on net-zero transition issues, followed by difficulty demonstrating a significant impact of physical risks on banks. It is also difficult at this stage to assess the impacts of adaptation measures in terms of reducing the bank’s financial risk. Financing adaptation also means that the bank increases momentarily its exposure to the physical risks of stakeholders while they actually adapt.

Where insurance and prevention companies are concerned, some actors that have proactively developed prevention offerings note a lack of interest from their clients. There are also difficulties mobilising insurers due to economic considerations about prevention, as further explained in this report.

The Cat Nat scheme, recognised as necessary by all, still needs to be adjusted to avoid diminishing accountability among stakeholders in the prevention chain (insurers and policyholders).

Public action is needed to drive real estate adaptation, by gradually engaging financial actors

The broader mobilisation of financial actors should be seen as complementary, but cannot replace other changes directly concerning the real estate sector environment (such as building regulations). Furthermore, as real estate project developers gain a better understanding of the economic profile of actions to adapt their activities, this should raise clearer questions about the roles of insurers, banks and asset managers.

Alongside these developments, it would be useful to continue to examine whether and how to implement the measures identified by the mission on the insurability of climate risks in France. In addition, it would be useful to continue to explore the tools available to financial actors, and the potential adverse effects that could arise as they take ownership of the issue.

This report is part of the Finance ClimAct project and was produced with the support of the European Union LIFE programme. This work reflects only the views of I4CE (the Institute for Climate Economics). The other members of the ClimAct Finance Consortium and the European Commission are not responsible for any use made of the information it contains.

With the contribution of the European Union LIFE programme