Supporting the practical use of climate financing needs estimates for EMDEs

Context

Finance is in the spotlight in international climate discussions. The recent difficult discussions and half-satisfactory outcomes on the New Collective Quantified Goal (NCQG) underscored just how critical this element is to climate action and global negotiations. However, country-level finance needs assessments are nearly always missing (I4CE 2024) , Chimowu, Hulme and Munro 2019), while they should provide the factual basis of such discussions and actions.

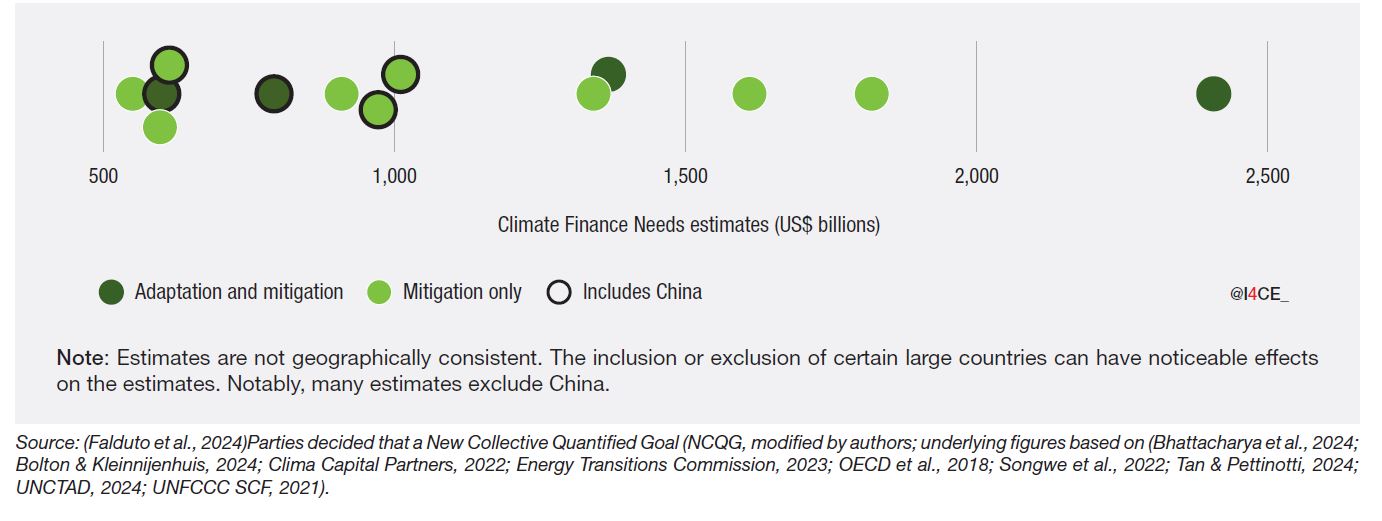

Global financing needs estimates try to make up for this gap. However, due to the lack of base data to work with, they are forced to various assumptions. When combined with variations in the scope of instruments, the dimensions of climate, nature, and development actions considered, and other factors, this results in widely divergent estimates (See Fig 1).

Figure. Sample estimates and uncertainty ranges of annual climate finance needs in developing countries by 2030

One the key reference points for these assessments, serving as an anchor in international negotiations, is the 2022 estimate by the Independent High-Level Expert Group on Climate Finance (IHLEG). This report estimates that approximately US$2.4 trillion in investment are needed annually by 2030 to support a “just energy transition, adaptation and resilience, loss and damage, and the conservation and restoration of nature” in EMDEs (Emerging markets and developing economies), excluding China.

The IHLEG report synthesizes a broad range of studies, but its foundation lies in earlier G7 work aimed at delivering a significant investment push in EMDEs to accelerate post-COVID recovery. That G7 initiative, in turn, draws heavily from a 2016 report on sustainable infrastructure investment needs in EMDEs, which adopts a broad interpretation of sustainability.

This draws several reactions:

- Some figures supporting this landmark IHLEG report rely on disparate climate objectives and incomplete data, and should be seen as indicative of the scale of effort required, not as precise forecasts.

- Part of the analysis relies on top-down methodologies, often based on assumptions – such as ratio-to-GDP proxies – to generate aggregated figures. As a result, although such a report appears to provide bottom-up estimates and country-level detail, much of the data is not actually usable for informing national plans or mobilizing domestic and international finance at the country level.

- Most estimates only cover investment needs, excluding the cost of capital, which is particularly high in EMDEs and hinders public and private developers from financing climate projects. Investment needs estimates should be aligned with realistic assessments of available financial resources to avoid gaps between ambition and feasibility

Objective

Given the high profile of such figures in international talks, this project aims to explore the main limitations of existing figures and identify areas for improvement, in order for climate financing needs estimates to meaningfully inform both international policy discussions and finance mobilization efforts at country level.

This research project draws upon I4CE’s expertise in transition financing plans and national-level financing needs assessments.

A first report was published in July 2025. Its main findings will feed into the Bruegel-CEPR Paris Report 3 on “Accelerating the Transition and Protecting Nature in EMDEs”.

Period

December 2024 – Ongoing