ClimINVEST – Tailored Climate Information for Investment Decisions

While climate impacts are already materializing, the regulators urge financial institutions to account for their exposure to “physical climate risks” when taking decisions, and to disclose how they do so. This represents a true challenge for financial institutions, in terms of expertise and risk management tools.

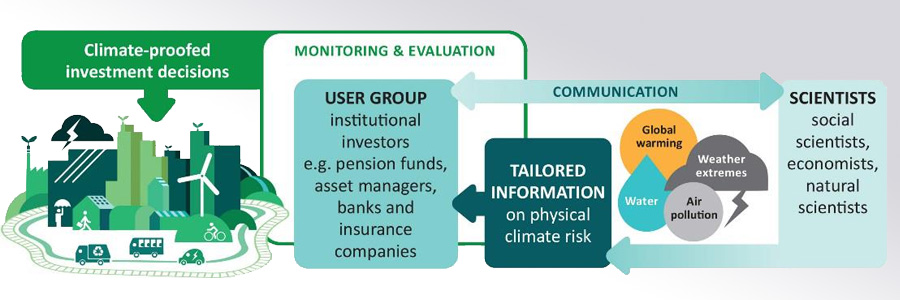

The ClimINVEST European project organized a direct collaboration between climate experts and financial institutions across Europe to identify and address the challenges of physical climate risk integration in finance. It results in publicly available resources that can be accessed through the figure below.

At the beginning of the project, the financial actors expressed a large array of needs covering every aspects of risk decision-making and starting with a strong demand for capacity building. In turn, I4CE worked with service providers to improve the transparency of their analytical tools developed for financial users, and with the consortium research partners to develop guidance on climate risk analysis and resources.

Pilot assessments was also a key aspect of the project. In France, I4CE, Carbone 4 and Météo-France collaborated with banking institutions (including the French Development Agency, BPCE, Caisse des Dépôts, HSBC, Natixis) to explore the capabilities of physical climate risk analysis on fictitious portfolios. It results in practical feedbacks and recommendations that I4CE and CICERO summarized in the final project report.

The ClimINVEST European Consortium:

During the three year and a half project period spanning from 2017 to February 2021, the consortium gathered specialists of climate finance; climate science; development and visualization of climate indicators in collaboration with investors.

Led by the Norwegian centre CICERO Climate Finance, the project team included Wageningen Environmental Research and Climate Adaptation Services from the Netherlands, as well as the French Institute for Climate Economics (I4CE), Météo France and Carbone 4.

For more information, please see the project’s principle website.

Romain Hubert, Project Manager at I4CE, explains in two minutes what the physical climate risk is and the challenges faced by banks :

Project ClimINVEST is part of ERA4CS, an ERA-NET initiated by JPI Climate, and funded by RCN (NO), ANR (FR), NWO (NL) with co-funding by the European Union (Grant 690462).