Connecting the dots between climate risk management and transition finance

The case of banks and their prudential authorities

A report to clarify linkages between these two approaches to climate action for the financial sector

The mobilization of the sector is necessary to help to finance the low-carbon transition. Some stakeholders thus advocate the explicit mobilization of the sector in favor of financing the transition. This rationale for action is known as the “transition finance approach”.

The sector is also exposed to the financial risks arising from climate change and the necessary transition. This observation motivates a rationale for action known as the “risk approach”, aimed at managing the exposure of financial institutions to such risks.

In practice, the prudential authorities have approached the climate issue through the prism of risks. A range of stakeholders have expressed the hope that the objective of better managing climate risks in the financial sector will help to mobilize the sector to finance the transition.

This report seeks to objectively clarify to what extent the risk approach could effectively lead to mobilizing private financial institutions to finance the transition. It focuses on commercial banking institutions and their prudential authorities at the European Union level. It is based on findings from the Finance ClimAct and 4i-Traction projects, as well as on broader research carried out by the authors and references from the literature.

When adopting the perspective of a commercial bank, the risk approach does not necessarily foster transition finance

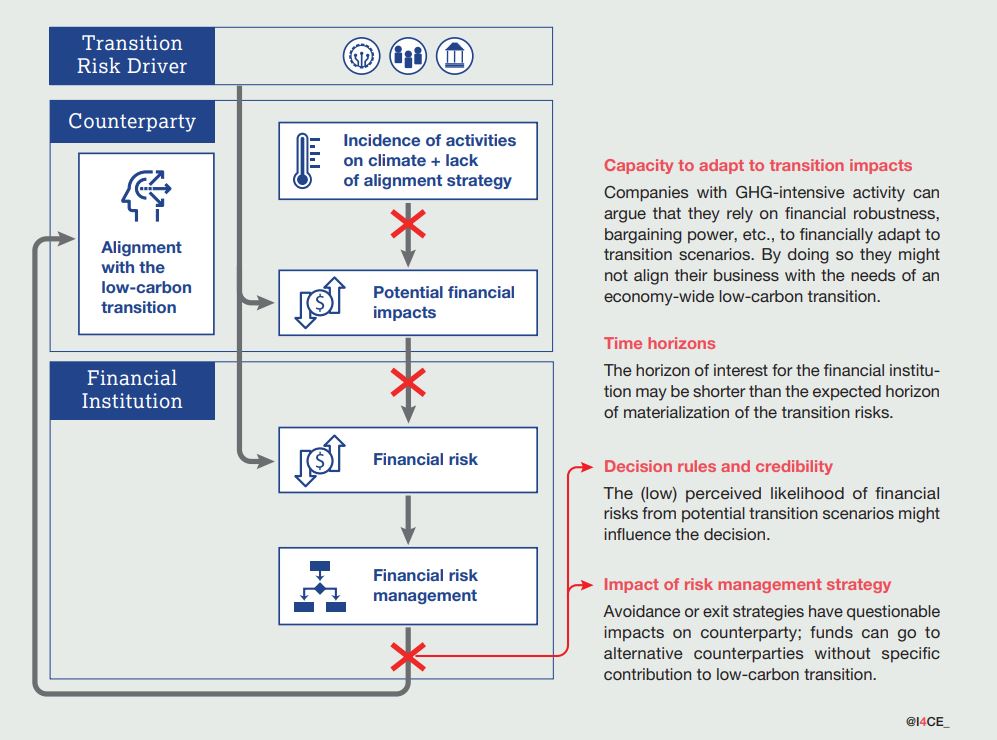

The “risk approach” of the bank seeks to manage the risk-return profiles of its portfolios. In theory, if the bank were to integrate transition and physical climate issues into its risk management process, this could result in financially penalizing the development of climate-harmful activities. It could also lead the bank to encourage the development of activities that are relevant for the low-carbon transition of the economy.

However, in practice, two types of conditions that are necessary for a bank’s risk approach to foster transition finance are not always met.

First, banks do not necessarily perceive climate-harmful activities as being financially riskier in their usual time horizon of interest. This relates, for example, to the assumption that a company that carries out such activities can rely on its financial robustness to manage the consequences of its exposure to transition and climate impacts. The bank may also consider that the company’s activity is risky only after the end of the contracted financial service. It could also subjectively consider that the scenarios that put the company at risk are not sufficiently credible to justify any revision of the company’s risk-return profile.

Second, when a bank makes a decision to actively manage its climate risk exposure, this is not necessarily beneficial to the transition. For example, if the bank disengages from a company involved in climate-harmful activities – by selling its equity share, no longer providing loans, and so on –, other actors may then propose similar financial services to that company, but with no intention of motivating the company to green its activities. The bank can also provide its financial services to other activities that make no significant contribution to the low-carbon transition, and all the more so given that activities that are favorable to the transition may be risky and unprofitable.

Visual – When a bank manages its exposure to transition risk from a company with climate harmful activities, this does not necessarily help to finance the transition

When adopting a prudential perspective, the risk approach shows greater potential for convergence with the transition finance approach

The risk approach of the prudential authorities includes a focus on financial stability. Their analyses clarify that an early, orderly and climate-ambitious transition considerably reduces the risk of financial instability in Europe compared with the other scenarios, both in the short and the long term. The financial supervisors also recognize that unabated climate change can be a significant source of financial instability and that their analyses currently underestimate the risks overall.

Given this current state of knowledge, the prudential authorities should therefore integrate the need to support an ambitious and orderly transition without delay. However, the actions taken so far (stress testing; supervisory expectations of climate risk management by the banks) were not explicitly aimed at stimulating transition finance and there is no guarantee that they will deliver substantial co-benefits in this respect. Typically, conditioning broader corrective actions for banks on the improvement of risk measures with stress testing may lead to a timeline of action that is not consistent with the urgency of carrying out an ambitious transition.

What the prudential banking authorities should do to unlock the potential of their risk approach to mobilize transition finance

Prudential authorities should implement two principles of action as defined in the report. The “proactive precautionary approach” would call for immediately taking the preventive actions needed to avoid the worst anticipated impacts, based on the current state of available information rather than waiting for perfect information. This would clarify that transition finance is a prudential priority. A “coordination principle” would also help to clarify the role of prudential authorities. The report illustrates how they should support the transition strategies decided by the governments, and how they should be active in adjusting their own approaches and help to build cooperations between public authorities where needed.

The prudential authorities will also need to address a broader range of climate-related prudential issues, for example the risk-taking issues of transition finance. While doing so, they should ensure that they contribute proactively to a policy mix that is compatible with the overarching objective of mobilizing transition finance.

For example, it will be important to frame Pillar 2 transition plans in a way that encourages banks to build granular, ambitious and applicable transition finance strategies, consistent with government actions, and without creating excessive risk-taking in the short-term.

This report is part of the Finance ClimAct project and was produced with the contribution of the European Union LIFE programme. This work reflects only the views of I4CE – Institute for Climate Economics. Other members of the Finance ClimAct Consortium and the European Commission are not responsible for any use that may be made of the information it contains.

With the contribution of the European Union LIFE programme