Global carbon accounts in 2023

4 key trends for 2023

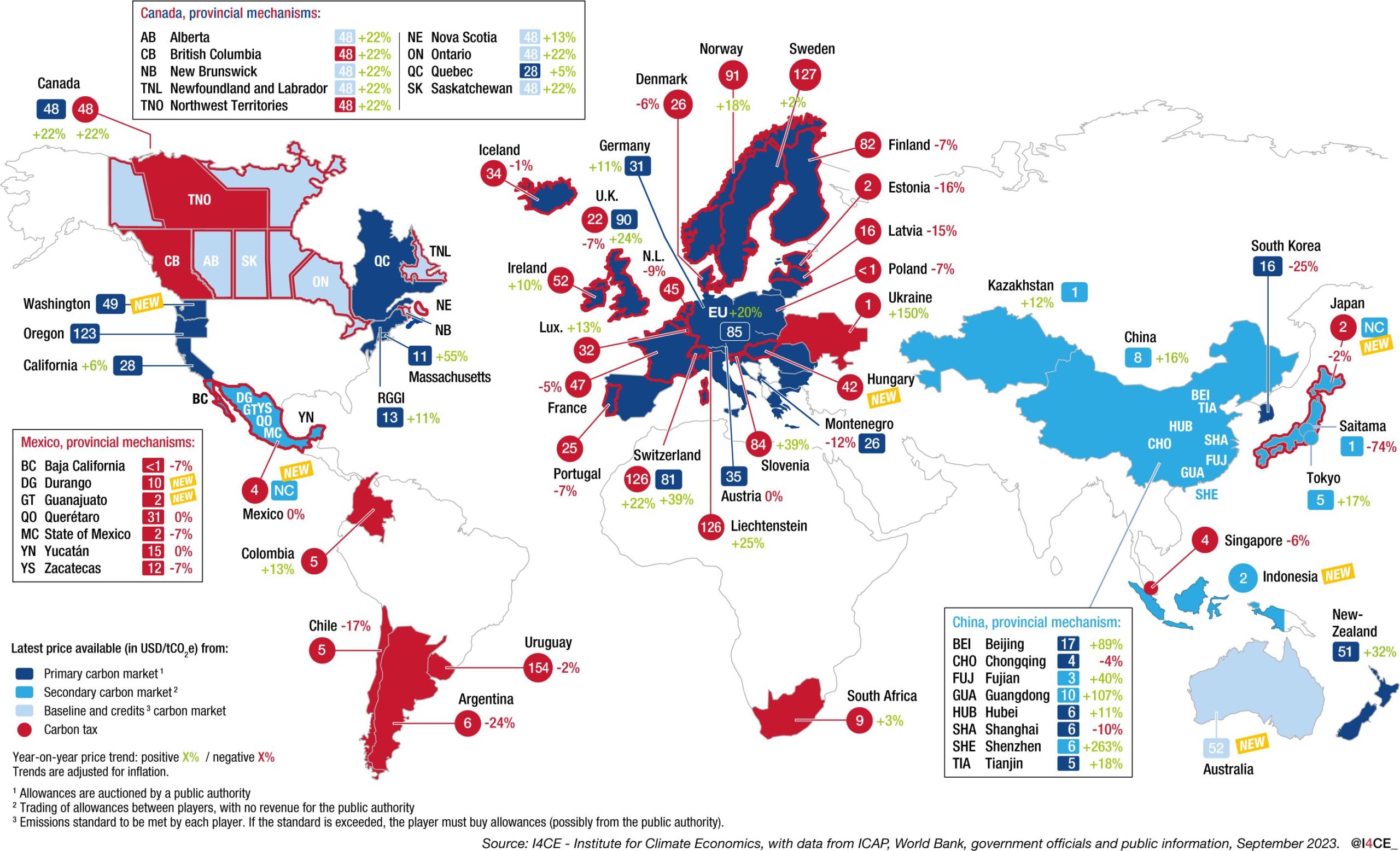

74 As of August 1st, 2023, 74 carbon pricing mechanisms have been identified worldwide, in either the form of carbon taxes or emissions trading schemes (ETS). These mechanisms can operate at different levels: 31 of them operate at the provincial level, 42 at the national level, and 1 at the interstate level (EU ETS). The jurisdictions covered by carbon pricing mechanisms accounted for 54% of global GDP in 2023 and 50% of global greenhouse gas (GHG) emissions.

USD 0,01-154 The range of explicit carbon prices is very wide: as of August 1st, 2023, they ranged from 1 cent per ton in Baja California (in Mexico) to USD 154 in Uruguay. Currently, over 70% of the covered GHG emissions are still priced at less than USD 20 per tCO2e. However, in 2017, the Stern-Stiglitz report estimated that the incitative effect of these mechanisms could only be fully achieved with prices ranging from USD 40 to 80 per tCO2e in 2020 and from USD 50 to 100 per tCO2e in 2030.

USD 93 Bn After reaching USD 97 billion USD in 2021, carbon pricing revenues have since stabilized at USD 93 bn in 2022. This relative decrease between 2021 and 2022 is mainly due to exchange rate movements over the same period and the reduction in auctioned allowances. More than 50% of carbon revenues are earmarked to green or development projects, 10% are redistributed to households or companies affected by carbon pricing, while the remaining (32%) goes into the general budget of each jurisdictions without any specific allocation (see p.10).

Although there has been an increase in the number of carbon pricing mechanisms within recent years, the majority of carbon revenues comes from 5 mechanisms which account for three-quarters of the revenues: the European, British and German ETS (44%, 8% and 7% respectively), and the carbon taxes in France and Canada (9% and 7% respectively).

24% This figure represents the share of emissions covered by a carbon pricing mechanism and includes emissions taxed at a either reduced price or covered by free allowances. If we only consider emissions taxed at the explicit price, this figure drops to 6%.

Zoom on the latest developments

Between 2022 and 2023, several new carbon pricing mechanism have been introduced worldwide. On a national scale, Indonesia launched the first phase of its ETS, covering 99 electric plants, or 80% of the country’s generating capacity. In Japan, 400 companies volunteered in the new ETS covering 28% of the country’s emissions. Australia has reformed the rules of its Safeguard Mechanism, transforming it into to a Baseline and Credits type ETS to cover 28% of national emissions. Finally, in Hungary, the government has announced the retroactive introduction of a tax, effective from January 1st, 2023, targeting companies that benefit from a significant allocation of free allowances under the EU-ETS. This tax consists of 2 components: a carbon price of EUR 40 per tCO2e, and a 10% transaction fee on the value of the free allowances obtained.

At the provincial level, in Mexico, the states of Guanajuato and Durango have implemented their own environmental taxes in 2023 including a component on GHG emissions. In Tamaulipas, the collection of allowances believed to be due to challenges faced by the state in measuring the emissions of companies are believed to be the reason for this failure. In Baja-California, many appeals have been granted by the Mexican judiciary, exempting the plaintiffs from paying the tax without abolishing it altogether, and stipulating that only the Federation had the power to tax petroleum products such as gasoline or diesel.

In the United-States, Washington State has launched its Cap-and-Trade ETS. The Regional Greenhouse Gas Initiative (RGGI), a multi-state ETS in the eastern United-States, is making news. Indeed, political battles continue in Pennsylvania to determine whether or not the state should join the RGGI, while Virginia is making progress in its efforts to withdraw from the same market. In North Carolina, the recent Senate votes make it highly unlikely that the state will join the RGGI. In Canada, Nova-Scotia, New-Brunswick, Prince Edward Island and Newfoundland and Labrador have abandoned their provincial carbon tax in favour of the federal levy. Nova-Scotia and Saskatchewan have modified their own ETS to meet the federal requirements (see p.3).

Impact of the energy crisis and the war in Ukraine in Europe

To contain the rise in energy prices, some European countries have taken measures targeting their carbon pricing instruments. In Portugal, where the carbon tax rate is linked to the previous year’s EUETS allowance price, it has been decided to freeze its tax rate at the 2021 level as of January 2022. Slovenia, using a similar fiscal instrument, tripled its carbon tax rate between 2020 and 2022, but then suspended its collection from June 21, 2022 until May 9, 2023. Austria delayed the implementation of its ETS by 3 months during the summer of 2022. Germany has frozen the increase in its mechanisms scheduled for 2023 and is using its ETS revenues to contain the rise in energy prices (see p.11). In Ukraine, carbon tax collection still continues in the oblasts unaffected by the conflict with revenues earmarked for a new ‘Decarbonization and energy efficiency Fund’ in 2024.

Map of explicit carbon prices around the world in 2023