Approches pour atteindre les objectifs de l’Accord de Paris : options pour les banques publiques de développement

Depuis l’adoption de l’Accord de Paris en 2015, plusieurs banques publiques de développement (BPD) ont réagi en structurant des approches pour aligner leurs opérations avec les attentes de cet Accord. Cependant, de nombreuses BPD, en particulier celles des marchés émergents et des économies en développement, doivent encore adopter une approche pour s’aligner avec l’Accord de Paris.

En tant qu’entités dont les mandats d’investissement sont établis par les parties à l’Accord de Paris (c’est-à-dire les gouvernements nationaux), les BPD ont des obligations spécifiques découlant directement des engagements de ces parties à agir à toutes les échelles politiques et réglementaires relevant de leur juridiction, y compris au niveau des institutions et agences appartenant à l’État ou mandatées par l’État. En conséquence, il est attendu des BPD qu’elles agissent en faveur de la réalisation des objectifs de Paris. Plus précisément, elles sont tenues d’intégrer leurs activités dans le mécanisme de mise en œuvre de l’accord, en fournissant un soutien financier, technique et de renforcement des capacités qui est entièrement compatible avec les trajectoires nationales de développement à faibles émissions et résilientes au changement climatique.

L’alignement avec l’Accord de Paris est défini dans ce contexte comme une réponse aux attentes spécifiques de l’Accord de Paris concernant l’intégration des BPD dans les moyens de mise en œuvre de l’accord. Pour être alignée avec l’Accord de Paris, une BPD doit orienter ses opérations de manière à fournir un soutien financier, technique et de renforcement des capacités qui soit entièrement cohérent avec les trajectoires de développement à faibles émissions et résilientes au changement climatique des pays bénéficiaires.

Ce concept d’alignement avec l’Accord de Paris diffère fondamentalement des approches qui se concentrent sur la réduction des émissions financées par une institution financière sur une trajectoire cohérente avec les objectifs de température de l’accord ou de celles qui suggèrent l’adoption d’actions climatiques communément rencontrées au niveau des institutions financières.

Bien qu’aucun des concepts alternatifs d’alignement avec l’Accord de Paris décrits ci-dessus ne soit suffisant pour faciliter l’alignement complet des BPD, certains de leurs composants ont été utilisés comme repères pour l’alignement.

Ce rapport vise à fournir des pistes concrètes d’action pour les BPD qui cherchent à aligner leurs activités avec les objectifs de l’Accord de Paris en évaluant les principales approches adoptées par les institutions financières et en identifiant les repères opérationnels les plus importants pour soutenir la mise en œuvre de ces approches.

Rapport uniquement disponible en anglais

Approaches to mainstreaming Paris Agreement objectives

On the other hand, private financial institutions have typically adopted the “portfolio-level net-zero” approach, which aims to achieve net-zero financed emissions at the portfolio level. While there is substantial variation in how this approach is implemented, it generally entails an accounting of financed emissions in an institution’s portfolio, then setting a year-on-year emissions reduction trajectory benchmarked against Paris temperature goals. In addition, private financial institutions have also adopted fossil fuel exclusions and counterparty engagement strategies to advance their mitigation efforts.

The portfolio-level net-zero approach is far narrower than the project-level alignment approach because it does not obligate consistency with low-emission climate-resilient development. Accordingly, the implementation of a portfolio-level net-zero approach alone would not achieve Paris alignment for PDBs.

This divergence in approaches results from the fundamentally different expectations that public and private financial institutions face under the Paris Agreement (see Section 1) and the distinct incentives driving their investment activities. Despite this divide, PDBs should at least be aware of how private-sector clients and partners are approaching climate action and, in some cases, may even benefit from strategically adopting aspects of the portfolio-level net-zero approach themselves (see Section 2.4).

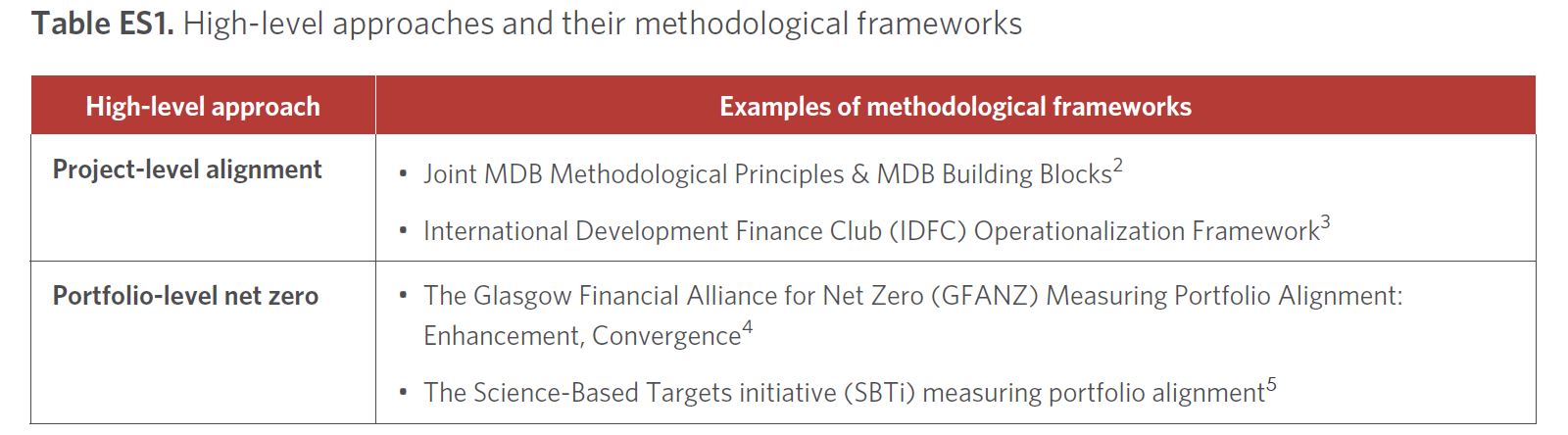

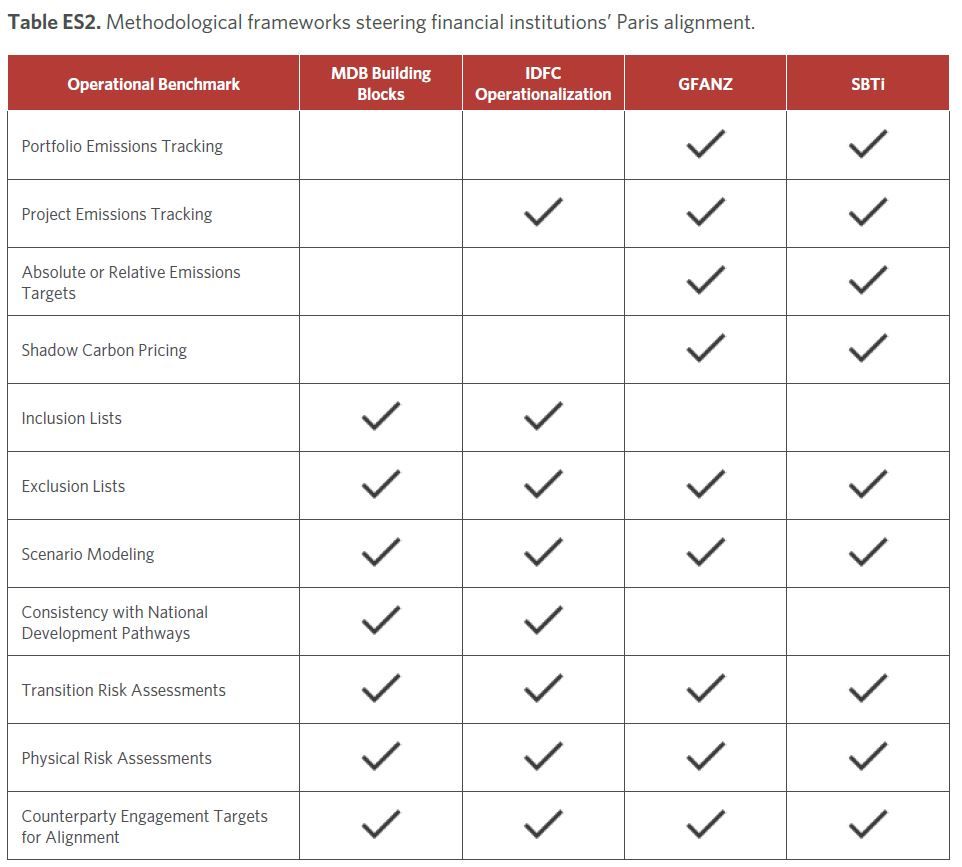

While there are myriad ways in which these high-level approaches are implemented across institutions, they are guided by a handful of key methodological frameworks, as shown in Table ES1.

Alignment approaches’ use of operational benchmarks

To effectively advance all of the Paris Agreement goals, PDBs should select and integrate operational benchmarks that are both practical and impactful. The MDBs’ joint Paris alignment approach (the MDB building blocks) offer a foundational approach for PDBs, focusing on improving understanding of their role in achieving the Paris goals and incentivizing the maximization of their impacts to this end. In addition, the concept of “do no harm” should be instilled as a minimum condition for PDB financing activities. PDBs should also seek to use benchmarks to maximize synergies between climate and other objectives in order to make efficient use of human and material resources and ensure applicability to the broad universe of PDBs.

Each of the various operational benchmarks offers distinct strengths and weaknesses for PDBs, depending on the bank’s client base and existing level of Paris alignment. While benchmarks can provide transparency, accountability, and measurable guidelines, employing the wrong ones can create operational challenges or conflict with existing priorities or mandates. Additionally, the associated technical capacity and resource requirements may become a hindrance.

Key takeaways from case studies

To better understand the methodological frameworks for Paris alignment approaches (e.g., the MDB building blocks) and the operational benchmarks adopted by financial institutions, this report presents six case studies examining the practices of five PDBs and one private financial institution.

These case studies have yielded the following key takeaways:

- All five PDBs featured have taken a project-level approach to Paris alignment, using multiple operational benchmarks to complete their assessments.

- Several PDBs have also integrated a net-zero portfolio approach; two use this to facilitate engagement with private-sector counterparts, while another uses its approach to align institutional activities more closely with the national climate goals of the countries in which they operate.

- A strong program for counterparty engagement is crucial to the implementation of either approach.

- PDBs that are active across multiple geographies and sectors require wider operational benchmarks to contextualize their alignment assessments.

Conclusions and recommendations

Our analysis of Paris alignment approaches, their constituent operational benchmarks, and key takeaways from case studies has led to the following conclusions and recommendations. These aim to guide PDBs in developing and improving their alignment approaches at various stages of implementation.

1. Project-level alignment forms the foundation of PDB support for Paris Agreement goals.

1a: PDBs that have not yet adopted a comprehensive alignment approach should start by outlining a project-level alignment approach to ensure that their future projects support the national low-emission climate-resilient development pathways of the countries in which they operate.

1b: Assessments of project-level alignment should use operational benchmarks that are as context-specific as possible, ideally incorporating context-specific aspects such as national development priorities, sectoral transition pathways, and transition and physical risks.

1c: In countries where national low-emission climate-resilient development pathways are yet to be established or lack detail, PDBs can engage national governments to develop long-term strategies and scenarios, along with corresponding financing plans, thereby connecting the project-level approach with the whole-of-institution approach.

2. Integrating operational tools from the portfolio-level approach can provide strategic benefits for banks that work closely with the private sector or operate in tandem with other governmental agencies on mitigation.

2a: PDBs that work frequently with private-sector clients should assess whether many of these clients have set transition planning and emissions targets (if relevant in the context of their operations).

2b: PDBs in markets where transition planning and emissions targets are common – or may soon become so due to new regulations, industry standards, or institutional peer pressure – should consider integrating tools from the net-zero portfolio approach to facilitate productive engagement with the transition approaches of private-sector clients and partners.

2c: PDBs that incorporate a portfolio-level net-zero approach must follow best practices for setting interim emissions targets, maintaining reporting and verification, and engaging with counterparties on emissions reduction. These practices should be communicated to clients and replicated by them where feasible.

2d: PDBs that have an advanced Paris alignment approach focused on providing transition finance and transformative impacts, as well as activities aimed at supporting the systemic and structural changes needed for a low-emission transition, may find that the net-zero approach contradicts their climate policies and even their development mandates, as limiting portfolio emissions would also limit their investment in transition activities.

3. Paris alignment is an evolving and ongoing process that requires consistent board and senior management support.

3a: PDB governance bodies need to fully engage in the planning and operationalization of a Paris alignment approach to ensure that it is properly implemented and clearly understood across all sub-departments and processes. This underscores the importance of board and senior management ownership of the process.

3b: Furthermore, PDB governance bodies, leadership, and internal operations teams should formally review their Paris alignment approaches on a regular basis to identify any possible gaps and revise benchmarks against any changes to low-emission climate-resilient development pathways and the latest science-based targets.

4. Stakeholder engagement is key to developing and implementing a Paris alignment approach.

4a: As PDBs develop alignment approaches, they should encourage clients and other external stakeholders to align their internal operations and client relations with suitable alignment approaches.

4b: Where financing activities fail to achieve the desired objectives of aligning clients’ goals with those of the Paris Agreement, PDBs should continue to engage with clients and other external stakeholders, especially their boards and shareholders. This is particularly important for PDBs that work with corporate clients, to track progress towards corporate transition goals.

4c: PDBs should also engage with each other through networks such as Finance in Common, which facilitate the sharing of best practices for the development and implementation of alignment approaches.

5. Further research can seek to identify which investments and support activities deliver systemic or transformative impacts.

5a: PDBs that have already implemented a comprehensive alignment approach can seek to develop methods and operational benchmarks to assess impacts. These can go beyond the direct mitigation or adaptation benefits generated by projects to assess the potential for systematic or transformative outcomes that support the largescale changes needed to transition to low-emission and climate-resilient economies.

5b: Similar to alignment, impact assessment will require context-specific information that accounts for differences in national low-emission climate-resilient development pathways.

1: The specific expectations facing PDBs under the Paris Agreement are summarized in Section 1.1.

2: World Bank, 2018

3 Lütkehermöller et al, 2021

4 GFANZ, 2022

5 SBTI, 2022